Nov 20, 2019

Alibaba's US$11B listing to propel Hong Kong to regain top IPO spot

, Bloomberg News

Alibaba Raises $11 Billion in Biggest Hong Kong Listing Since 2010

Alibaba Group Holding Ltd.’s US$11 billion Hong Kong listing is set to propel the financial hub to the top spot globally in terms of fundraising from initial public offerings.

The share sale by the e-commerce giant is a huge boon for Hong Kong, which has been rocked by increasingly violent anti-government protests and earlier this year lagged rival New York exchanges in IPO volumes.

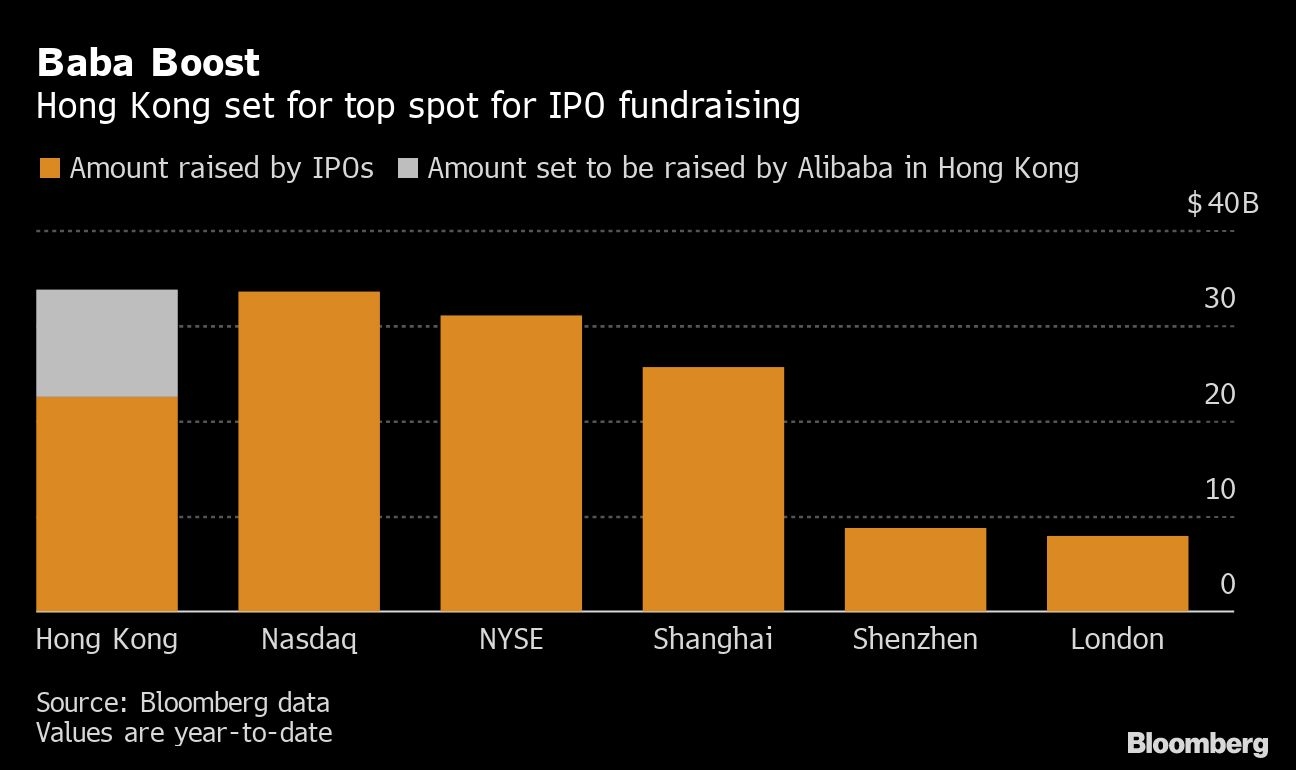

Companies have raised US$22.6 billion from IPOs listing on Hong Kong’s stock market this year, data compiled by Bloomberg show. Alibaba’s listing is set to push that to about US$33.8 billion, just ahead of the US$33.5 billion raised by companies listing on the Nasdaq. Companies have raised US$31 billion so far on the New York Stock Exchange.

Hong Kong held the top spot last year thanks to a number of multibillion dollar IPOs but dropped to fourth place earlier this year as offerings dwindled. It has been No. 1 for three of the past five years: in 2018, 2016 and 2015.

After a summer drought marked by Anheuser-Busch InBev NV’s failure to pull off a US$9.8-billion IPO of its Asian unit, Hong Kong managed a rebound in the autumn, topping all other exchanges for first-time share sales over September and October.

Alibaba’s smooth sailing in its share sale so far is proof that Hong Kong remains a viable fundraising venue despite raging protests that have forced the cancellation of multiple events and a U.S.-China trade war that has roiled markets.

Still, 2019 is far from over and New York’s markets could still stage a comeback given Hong Kong’s razor-thin lead. And Alibaba’s successful listing does not mean the door is open for everyone. On Monday South African gold mining company Heaven-Sent Gold Group Co. had to shelve its Hong Kong IPO because of "market conditions."

UPCOMING LISTINGS:

Alibaba Group Holding

• Hong Kong exchange

• Size about US$11 billion

• Pricing Nov. 20; listing Nov. 26

• Credit Suisse, CICC

Postal Savings Bank of China

• Shanghai exchange

• Size US$4.1 billion

• Taking orders Nov. 28

• Citic Securities, CICC, China Post Securities, UBS Securities

China Zheshang Bank

• Shanghai exchange

• Size US$1.9 billion

• Took orders Nov. 14; listing date TBA

• Citic Securities

Pharmaron Beijing

• Hong Kong exchange

• Size up to US$588 million

• Pricing Nov. 21; Listing Nov. 28

• CLSA, Goldman Sachs, Orient Capital

Venus Medtech

• Hong Kong exchange

• Size up to US$400 million

• PDIE Nov. 11-22

• Goldman Sachs, CICC, Credit Suisse, China Merchants Securities

China Merchants Commercial Reit

• Hong Kong exchange

• Size about US$400 million

• Started gauging demand Nov. 14; listing date TBA

• Citigroup

Canaan

• Nasdaq

• Size US$110 million

• Pricing Nov. 20

• Citigroup, China Renaissance, CMBI, Galaxy Digital, Huatai Securities, Tiger Brokers, Haitong International

Bangkok Commercial Asset Management

• Thailand stock exchange

• Size up to $1.16 billion

• Listing date TBA

• Trinity Securities, Kasikorn Securities

Longyan Zhuoyue New Energy

• Shanghai Star board

• Size $191 million

• Took orders Nov. 11; listing date TBA

• Yingda Securities

More ECM situations we are following:

• Wall Street banks working on Saudi Aramco’s share sale are set to lose out on a highly-anticipated fee windfall after the deal was pared back from a record global offering to a mainly domestic affair.

• SDIC Power Holdings is considering proceeding with an offering of global depositary receipts representing A shares of the company, according to a statement.

• An investor in the sports unit of Chinese billionaire Wang Jianlin’s real-estate-to-entertainment group is leading a lawsuit against the company, alleging Wanda Sports Group Co. and its bankers disseminated false and misleading statements related to a July initial public offering.

• Yeahka Ltd., a Chinese payment technology services provider, is planning to raise about US$300 million in an initial public offering in Hong Kong, according to people with knowledge of the matter.

SEE ALSO

• Asia ECM Weekly Agenda

• IPO data

• U.S. ECM Watch

• EU ECM Watch

--With assistance from Zhen Hao Toh.