Mar 22, 2024

All-Tolerant Powell Sends Wall Street Into a Buying Frenzy

, Bloomberg News

(Bloomberg) -- Arguments on Wall Street rage anew over Federal Reserve policy — and how Jerome Powell should handle soaring asset prices. Yet for traders there’s no debate about what to do right now as they sink money across markets of all stripes.

More cash has been sent to exchange-traded funds tracking corporate bonds over five months than any time since the Fed was propping up the market during the Covid-19 pandemic — $46 billion in all. All told, ETFs tracking stocks, fixed income and commodities lured $374 billion over the stretch, the most in two years.

In the run-up to potentially three interest-rate cuts this year, the equity rally of late has no real precedent. The S&P 500 has surged 27% since October — on track for the biggest-ever advance since at least 1970 ahead of a likely monetary-easing cycle, according to data compiled by Ned Davis Research and Bloomberg.

Now stocks just had their best week of the year as the Fed meeting and accompanying press conference added fuel to a fire that’s been burning in markets since October.

Traders sensed a change in tone: Growing comfort among policy makers with a slower road to their 2% inflation goal, as Powell repeatedly said the path will be “bumpy.” Asked about financial conditions, the Fed chief said they are restrictive — a proposition many consider dubious at best given $13 trillion has been added to stock and bond values since October alone.

“What matters at these times is what is said and not what should be said,” said Michael Shaoul, chief executive officer at Marketfield Asset Management. “From our perspective, the FOMC has overestimated the progress made against inflation and is underestimating the risk of asset booms moving uncontrollably higher.”

Move higher they did in a week in which Powell’s refusal to mention markets or fret excessively over hotter-than-forecast consumer price data burnished his growing reputation as investors’ ally-in-chief — disinclined to take the bait to jawbone markets lower. Newly released Fed estimates showed policy makers remain committed to three rate reductions in 2024 even as their forecasts for inflation and growth tick up. Bond traders assigned 69% odds for the first cut to happen in June.

To be sure, both traders and the Fed have overestimated prospects for dovishness before, and with technology stocks in the S&P 500 trading near 30 times earnings estimates, even a widely anticipated easing cycle may not be enough to goose returns further. For now, at least, the celebration showed few signs of slowing.

Volatility has been easing across assets especially Treasuries, where previous bouts of turmoil had impeded gains in stocks, crypto and credit. The ICE BofA MOVE Index, which tracks expected turbulence in US bonds via options on interest-rate swaps, now sits near levels last seen before the central bank kicked off its policy-tightening campaign in 2022.

For the first week this year, equities, fixed income and commodities posted harmonized gains, going by ETFs tracking their returns. While Bitcoin retreated after surpassing $73,000 for the first time, the largest cryptocurrency is still up 50% since January.

The Fed’s reiteration of its dovish outlook drew criticism from the likes of former Treasury Secretary Lawrence Summers, who doubted the urgency of lowering rates. Yet with Powell signaling willingness to let the economy run hot, bulls took it as a buy signal. Two-year Treasury yields fell while stocks jumped to all-time highs.

Exactly four years after the Fed announced plans to purchase corporate-bond ETFs to help ease market stress during the pandemic crisis, sentiment is indisputably more upbeat. The extra yield that investors demand for holding corporate debt has narrowed to levels not seen since 2021.

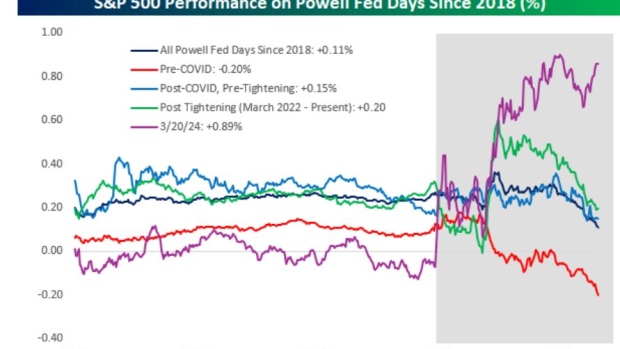

Up almost 1%, the S&P 500 on Wednesday scored the eighth-best post-announcement performance for a Fed day during Powell’s tenure, according to data compiled by Bespoke Investment Group. The reaction contrasted with January, when Powell threw cold water on investors’ hopes that rate reductions would begin in March. The buoyancy also bucked a trend since he took the helm in 2018, in which the equity benchmark has tended to slide from afternoon’s press release to the market close.

“Just as we live in a world defined by a rapid pace of technological change, the way the market reacts to Powell Fed meetings may also be starting to shift,” said Paul Hickey, a co-founder of Bespoke. “If rate hikes are out of the equation, investors are willing to be patient with the timeline of rate cuts.”

From small-caps to industrial shares, all major equity indexes climbed in a week that was packed with central bank decisions and a widely watched event hosted by Nvidia Corp., the poster child of the artificial intelligence craze. Shares of the chipmaker advanced for a record 11th straight week as Chief Executive Officer Jensen Huang unveiled a new processor design called Blackwell.

The market resilience caught Andrew Tyler by surprise.

“We entered the week cautious that TMT events could be sell-the-news events and with risk that the Fed made a hawkish pivot following the recent inflection higher in inflation data,” Tyler, the head of US market intelligence at JPMorgan Chase & Co., wrote in a note to clients. “Clearly, that did not work out.”

He’s not alone in under-estimating Powell’s patience in the inflation-fighting campaign. Investors pulled $24 billion out of US stock ETFs in the week through the Fed day, only to come back and add almost $2 billion the following session, according to data compiled by Bloomberg.

While every cycle is different, history shows investors would be better off sticking around if the Fed’s rate scenario pans out. All but one of the previous 12 rate-cut cycles saw stocks go up, with the S&P 500 climbing a median 15%. The favorable pattern is also true for Treasuries and corporate bonds even though their performance tracked by Bloomberg indexes doesn’t go back as far.

Christian Hoffmann, a portfolio manager at Thornburg Investment Management, said he was disappointed that Powell didn’t make a strong commitment to the central bank’s inflation target. The Fed chair needs to walk a fine line in a year of presidential elections, where any major policy shift could draw ire from either Republicans or Democrats, he added.

“The Fed is signaling to me that they may be quietly quitting their immediate goal of 2% inflation with a willingness to tolerate higher inflation,” Hoffmann said. “In theory, the Fed is an apolitical organization, sensitive to scrutiny and criticism. Making big changes to monetary policy into a contentious election could present troubling optics.”

--With assistance from Katie Greifeld, Isabelle Lee and Michael Tsang.

©2024 Bloomberg L.P.