Mar 27, 2024

Amazon Says Japan Isn't Meeting Corporate Needs for Clean Power

, Bloomberg News

(Bloomberg) -- Amazon.com Inc., the world’s biggest corporate buyer of clean electricity, delivered a clear verdict on Japan’s energy policy earlier this month: The country isn’t moving quickly enough to deliver green power to the private sector.

“If a company with Amazon’s scale cannot procure power at scale in Japan, then there's something wrong with how we're enabling new projects to come online quickly enough to meet the demand that's growing,” Ken Haig, head of energy and environmental policy for the Asia-Pacific region for Amazon Web Services said at a Renewable Energy Institute conference in Tokyo. “There are many, many companies looking for renewable power here in Japan. We need more supply to meet that demand.”

Japan has become a difficult market for companies that need green electricity to meet internal emissions targets and customer demands. The country currently relies on fossil fuels for more than 70% of its power generation, and while it committed along with the rest of the world at COP28 in Dubai in December to tripling global renewable capacity by 2030, the country plans to keep burning coal, oil and gas for much of its electricity.

The government is making the utmost effort to make renewable energy the main source of power, the New and Renewable Energy Division within Japan's Agency for Natural Resources and Energy said in a statement.

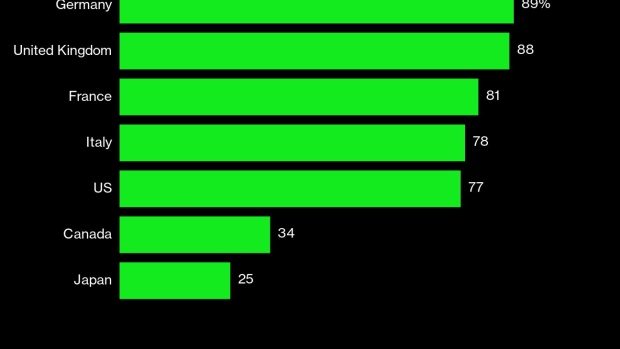

A group of more than 400 global firms has been calling on Japan since 2021 to increase its investments in renewable energy, so that clean power could make up roughly half of the energy mix by 2030, from a target of around 38% by the end of this decade. That strategy is typically reviewed every three years or so and the government is expected to revisit it starting this year. In 2022, RE100 companies were able to meet 25% of their demand for electricity in Japan from renewable sources, lower than the global average of 50%.

Japan’s energy policymakers say that the country’s mountainous terrain and relative isolation as an island nation make it more difficult and costly to develop renewable energy at scale. At the same time, the country’s power grid remains isolated, a legacy of Japan’s 10 major regional utility monopolies, making it difficult to get renewable power to where it can be used. Japan is leaning heavily on future technologies like carbon capture and storage, or co-firing of ammonia or hydrogen, to reduce the CO2 emissions generated by fossil fuels, but that doesn’t meet the needs of companies committed to renewable energy now.

Amazon has announced more than 500 renewable energy projects globally, although Haig emphasized it’s difficult for the company to procure clean electricity across Asia. A power purchase agreement signed in 2022 with Indonesia’s state utility Perusahaan Listrik Negara to buy clean electricity from a solar project is bigger than the cumulative amount of power Amazon has been able to procure in Japan, he said.

“It's very hard for us to purchase renewable power in this part of the world,” he said referring to Asia. “We're trying to fix that. It's not a technology problem, it's a policy and market problem.”

Japan has announced a plan to invest more than 150 trillion yen ($990 billion) in public and private money for so-called green transformation, which includes 31 trillion yen for renewables, the second-largest allocation after automotive.

But climate analysts say the nation needs to do more. Spending allocations from the debt instrument are misaligned with the Intergovernmental Panel on Climate Change’s guidance on limiting the rise in global temperatures, climate research group InfluenceMap said in November.

Global companies with operations in Japan as well as domestic firms have renewable targets they are aiming to make by 2030 but insufficient supplies are jeopardizing those goals, said Kahori Miyake, co-chair of Japan Climate Leaders Partnership, which partners with the RE100.

“We're trying as much as possible as individual companies but the total amount of clean energy that is available in Japan is just not enough at the moment,” said Miyake.

©2024 Bloomberg L.P.