Housing is expected to be a key topic in the upcoming federal budget, but the majority of people who live in Canada say they don’t believe affordability issues can be helped with government policy measures alone.

That’s according to a new poll from Zoocasa that found that while most (82 per cent) of the country’s residents say the issue of housing affordability is negatively impacting Canadians, 55 per cent said government policy intervention isn’t enough to fix the problem.

With housing shaping up to be a big campaign issue ahead of October’s federal election, Finance Minister Bill Morneau has signalled his pre-election budget on March 19 will include measures aimed at making housing more affordable for young buyers.

Since Morneau first hinted in January that the government is considering ways to address housing affordability, experts have weighed in with suggestions like increasing maximum amortization periods — the total length of time it takes to pay off a mortgage – and changing mortgage stress test rules.

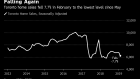

The Toronto Real Estate Board notably called for a review of the Office of the Superintendent of Financial Institutions’ mortgage rules earlier this month, after Toronto’s housing market posted its biggest monthly sales decline in a year in February.

However, only 15 per cent of respondents to Zoocasa’s poll said changes to the stress test rules would be the most helpful government measure, while more than one-quarter (28 per cent) said the most effective action would be increasing the first-time homebuyers’ tax credit. Only 10 per cent said raising the maximum mortgage amoritization rate would be the best option to ease affordability issues.

The poll was conducted online from March 1 to 11 and surveyed more than 1,000 people living in Canada.