May 10, 2024

Bank of America Sees Short-Term Stock Trading Hurting Returns

, Bloomberg News

(Bloomberg) -- Equity investors looking at trading shares within a shorter period of time instead of holding them for longer are potentially limiting their returns, according to analysts at Bank of America.

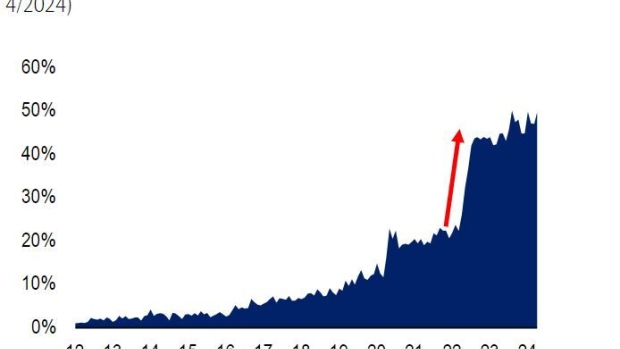

Trading horizons are getting shorter, with zero-day-to-expiry options now accounting for almost half of all S&P 500 index option volumes, up from less than 5% a decade ago. But the odds of losing money in the S&P 500 drop from 46% for holding a position for a single day to 5% for carrying those investments for a decade, the analysts led by Savita Subramanian wrote in a Friday note.

Timing the market is especially fraught. Since the 1930s, missing the 10 best S&P 500 days per decade would have yielded a gain of 66%, versus the 23,000% return they could have got if they remained invested, according to the analysts.

©2024 Bloomberg L.P.