Jan 30, 2021

Banxico Surplus Likely to Be 10% or Less of What AMLO Once Hoped

, Bloomberg News

(Bloomberg) -- Mexico’s central bank will probably send the government a small fraction of the 300 billion-peso ($15 billion) foreign exchange surplus that President Andres Manuel Lopez Obrador has hoped for, after a comeback of the peso at the end of 2020 reduced the institution’s profits.

The bank, known as Banxico, will likely transfer to the Treasury just 20 billion to 30 billion pesos, according to two people familiar with the matter. The final figure has not yet been decided and it could be as low as zero, they said, declining to be named discussing private affairs.

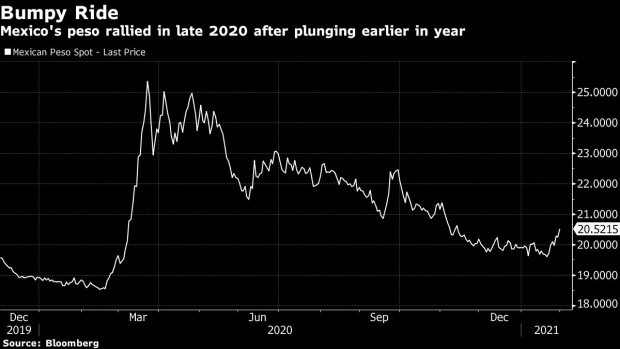

A depreciation of the peso typically boosts the central bank’s profits from its dollar-denominated reserves. While Banxico has discretion on how to use the surplus, including to strengthen its own balance sheet, the government had expected last year to receive a much-needed windfall after the economy had its worst collapse in nearly a century.

AMLO, as the president is known, had acknowledged earlier this month that the recent strength of the Mexican peso had greatly reduced that surplus, known in Spanish as “remanente.”

“There were calculations that we may get as much as 1 trillion pesos from the Banxico surplus,” he told reporters on Jan. 6. “It’s estimated that this surplus will be very small given the stronger peso,” he said, adding that he was hoping instead for 300 billion pesos.

One of the people told Bloomberg News that while a zero surplus was possible, political considerations make it unlikely that the bank would send nothing to the Treasury. Banxico declined to comment on the surplus. A Finance Ministry spokesperson didn’t respond to a request to comment.

Deputy Finance Minister Gabriel Yorio said at a press conference Friday he expects the surplus to be “very small” if there is one at all due to the peso’s climb. The smaller payout isn’t a worry since a stronger peso makes it cheaper to pay down the Mexico’s debt, he said.

Banxico paid a surplus to the Treasury for the last time in early 2017, when it transferred 321.7 billion pesos after profits for the 2016 fiscal year.

Peso Rally

The squeeze on the surplus is mostly due to the peso’s end-of-year rally. The currency climbed 11% in the fourth quarter, the third-best performance among 24 emerging market currencies tracked by Bloomberg. It had lost as much as 33.7% of its value earlier in the year.

Read more: Mexico’s Buoyant Peso May Not Be All About Carry Trade for Now

Private sector projections have varied wildly on the surplus. Five economists asked by Bloomberg News gave figures veering from zero to 200 billion pesos. Finance Minister Arturo Herrera said in September, before the peso’s gains, he expected to receive between 150 billion and 250 billion pesos at a minimum.

Twenty billion to 30 billion “is the most it could be, given the low depreciation we observed,” said Gabriel Casillas, chief economist at Banorte. “It actually could be zero if you considered the capital restitution and reserves constitution that the bank should do, using the operational surplus.”

UBS wrote in a report in early January that the central bank’s first use of profits would be to recapitalize itself, after ending 2019 with negative equity.

Banxico has recently been involved in a political battle, fiercely trying to shoot down a bill passed by the Senate in December that would force it to buy surplus cash from Mexican banks, which it says could expose it to money laundering.

Lawmakers are due to hold talks on the bill starting next week after Lopez Obrador said they needed to find a solution that didn’t affect the bank’s autonomy or risk conflict with international organizations.

Read more: Mexico Lawmakers to Start Talks on Banxico Dollar Bill Monday

(Updates with comment from Deputy Finance Minister in seventh paragraph.)

©2021 Bloomberg L.P.