Jun 19, 2019

Barnes & Noble, poised to go private, posts another sales drop

, Bloomberg News

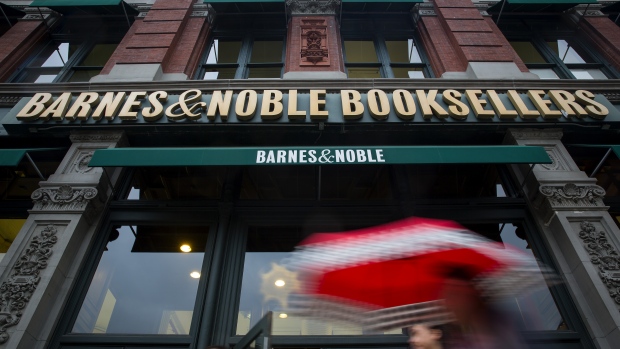

Barnes & Noble Inc. (BKS.N), on the verge of going private in a deal with Elliott Management Corp., reported another quarter of declining sales -- underscoring the challenge the New York hedge fund will face in turning the book retailer around.

Sales of US$755.4 million in the most recent quarter represent a decrease of 3.9 per cent from the same quarter a year earlier. The company also reported comparable sales, a key measure of retail success, fell 2.3 per cent.

Key Insights

Elliott is putting James Daunt, chief executive officer of its British chain Waterstones, in charge of Barnes & Noble. The results show that Daunt will have his work cut out for him to reverse the chain’s steady sales declines.

Daunt has helped Waterstones improve by giving individual stores more autonomy in tailoring their offerings to local preferences. It’s still not clear what path Elliott will take with Barnes & Noble.

One positive sign was a slight improvement in gross margin, which rose to 29.4 per cent, from 29.1 per cent a year earlier.

Market Reaction

The shares fell less than one per cent in early trading on Wednesday. Tuesday’s closing price of US$6.68 is above Elliott’s buyout price of US$6.50.