Jul 21, 2020

Bitcoin Daily Transaction Value Is Set to Fall Below Tether’s

, Bloomberg News

(Bloomberg) -- Bitcoin was supposed to be the cryptocurrency for the masses. Instead, a different type of digital token has emerged as the blockchain world’s dominant force.

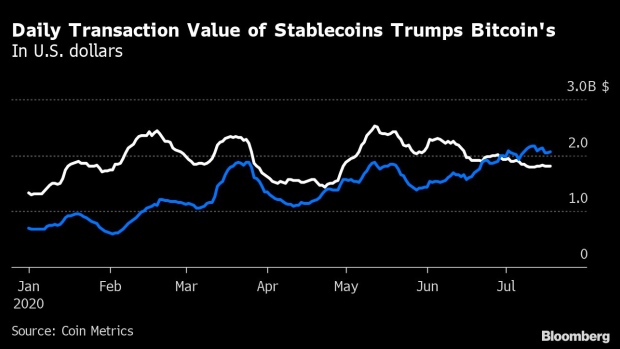

The aggregate daily dollar value of transactions made in stablecoins --essentially, digital assets such as Tether and USD coin that are pegged to world currencies like the greenback -- surpassed that of Bitcoin’s for the first time on June 29, according to researcher Coin Metrics. Tether is poised to surpass Bitcoin by itself, according to researcher Messari.

“At this pace it looks like Tether alone will catch Bitcoin within a month or two,” said Nic Carter, co-founder of Coin Metrics, whose data Messari used.

Tether, the dominant stablecoin, has also been the most controversial since its debut in 2015. The entities that control the coin are currently embroiled in a dispute with New York’s attorney general over alleged misuse of client funds, claim the company has denied.

Tether and other stablecoins are often used by people operating outside banking and government controls such as for settlement by Asian export and import businesses, and in various lending and borrowing apps that have sprung up.

“Most users do not want to transact in volatile cryptocurrencies like Bitcoin or Ether, preferring to hold them instead, so stablecoins are a great complement,” said Ryan Watkins, research analyst at Messari.

The daily amount doesn’t include transactions that occur within crypto exchanges, where Tether often serves as a conduit to conduct trading between different coins.

“This doesn’t mean there isn’t a role for ‘native’ cryptocurrencies to play, but it does mean that they have surrendered a fraction of their touted utility to the more convenient stablecoins,” Carter said.

©2020 Bloomberg L.P.