Dec 28, 2021

Bitcoin on longest winning run since 2019 after hitting record

, Bloomberg News

Bitcoin is becoming a great hedge against piling global debt: Crypto currency hedge fund

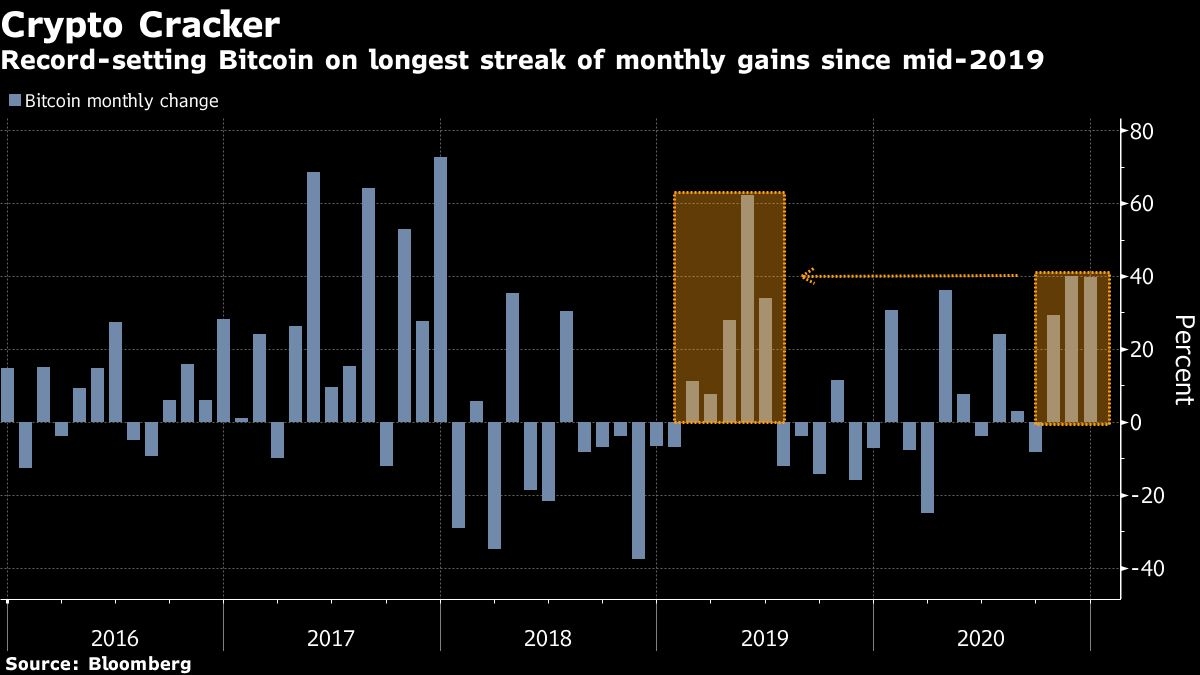

Bitcoin is on track for its longest monthly winning streak in more than a year after touching a record above US$28,000 over the weekend.

The largest cryptocurrency reached an all-time high of US$28,365 on Sunday before paring some of the advance, according to a composite of prices compiled by Bloomberg. The run of outsize returns over October, November and December so far is the longest such stretch since mid-2019.

“My sense is we’re very close to a top -- we could hit US$30,000 though,” said Vijay Ayyar, head of business development with crypto exchange Luno in Singapore. “We should definitely see a pullback, but the magnitude is probably lesser. We might only see 10 per cent to 15 per cent drops.”

Bitcoin climbed as much as 3.6 per cent on Monday and was trading at about US$27,260 as of 9:25 a.m. in New York. The cryptocurrency has advanced about 270 per cent this year, while the wider Bloomberg Galaxy Crypto Index is up 260 per cent.

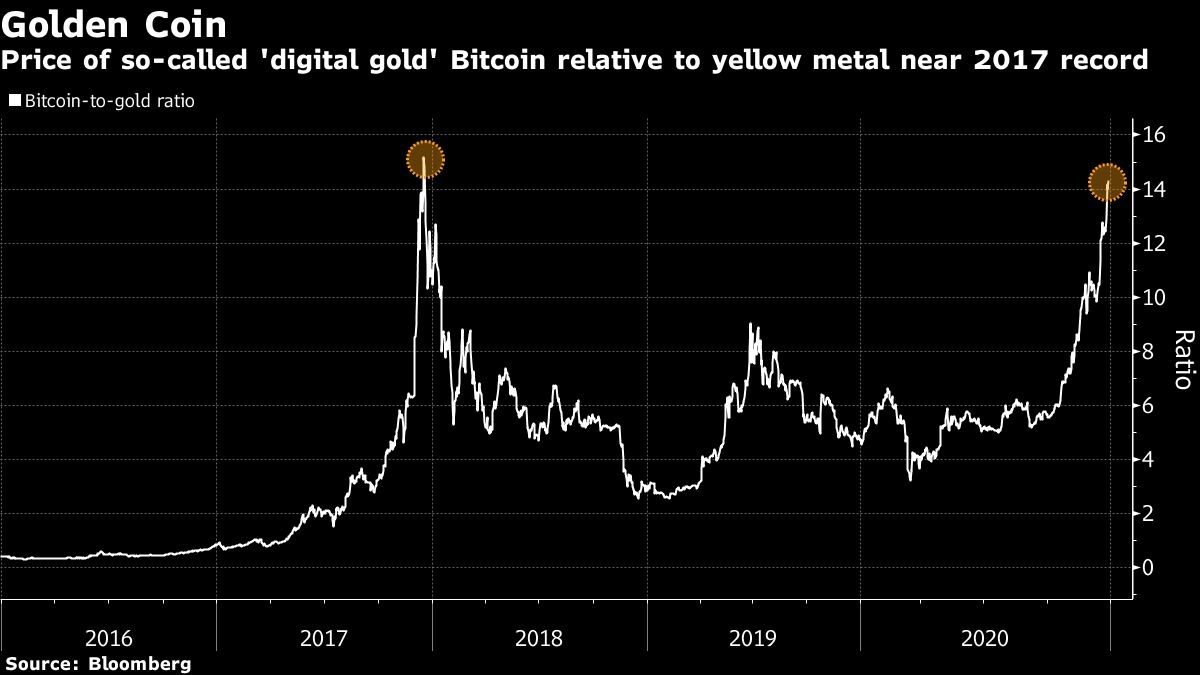

Bitcoin has divided opinion as its price more than tripled in 2020 amid a worsening pandemic. Believers see it as a hedge against dollar weakness and the risk of faster inflation amid huge stimulus injections, and cite growing interest from institutional buyers. Others question Bitcoin’s validity as an investment and point to the digital currency’s history of wild rallies followed by crashes.

Regulatory scrutiny of the still-nascent cryptocurrency industry continues to be a variable for investors to consider.

The Securities and Exchange Commission last week accused Ripple Labs Inc. and its top executives of misleading investors in affiliated token XRP. While Ripple plans to challenge the accusation in the courts, the development underscores the prospect of stricter oversight of digital assets.

Ayyar said investors are shifting to Bitcoin and other digital coins in the wake of the XRP development.

Edward Moya, senior market analyst at Oanda, says demand for Bitcoin is “relentless.”

“Bitcoin is still the trendy trade on Wall Street and that might not go away,” Moya wrote in a note Monday. “Volatility remains elevated, but for now seems like it will attract buyers on every major dip.”

--With assistance from Claire Ballentine and Vildana Hajric.