Jan 19, 2021

Bitcoin's turbulence helps kindle rally in largest rival Ether

, Bloomberg News

Feds not adding to Bitcoin to reserves; Canadian banks stay mum

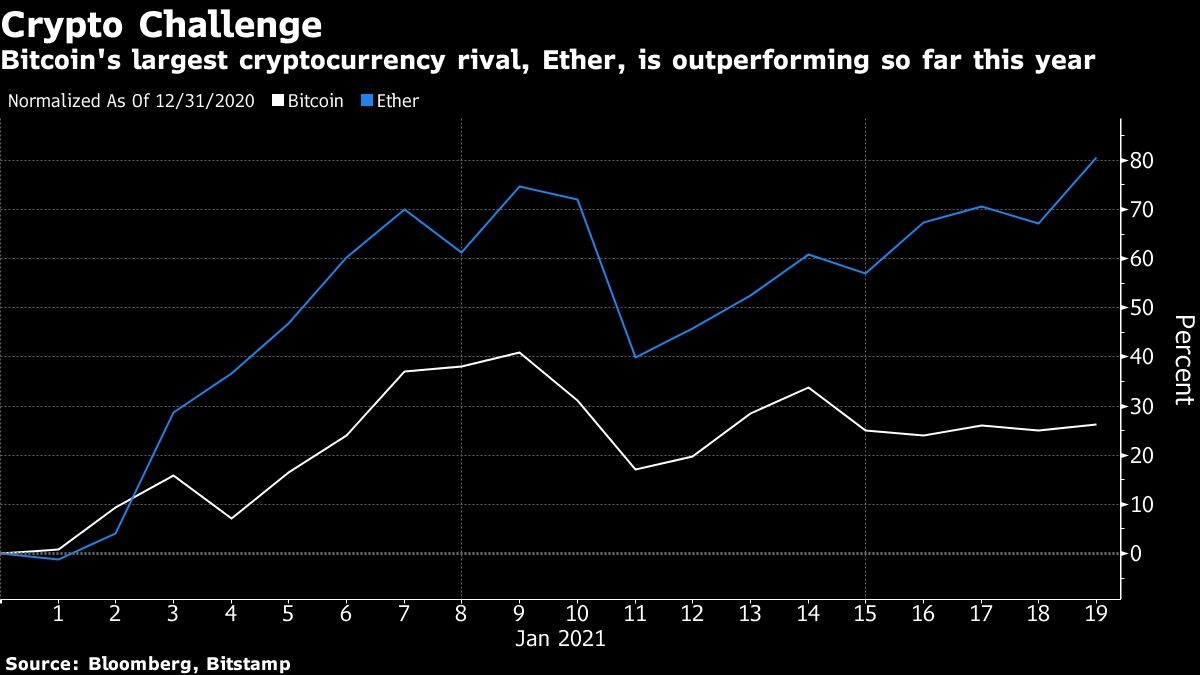

Bitcoin’s recent wobbles have turned the cryptocurrency spotlight onto other digital coins including Ether, whose gain this year has outstripped the performance of its bigger rival.

The world’s largest cryptocurrency hovered around US$37,000 on Tuesday after major gyrations earlier in January. The comparative calm of late may encourage crypto enthusiasts to chase the momentum in coins like Ether, which is up almost 90 per cent in 2021 compared with Bitcoin’s 27 per cent advance.

“Bitcoin has been in a range for the past few weeks, which gives time for capital to rotate” into other digital assets, said Vijay Ayyar, head of business development with crypto exchange Luno in Singapore.

Questions abound about the drivers of the parabolic surge in Bitcoin to almost US$42,000 on Jan. 8 before a sharp pullback. A study by Bloomberg Economics suggests animal spirits account for the bulk of the move, while Bitcoin’s claimed role as a hedge against risks such as inflation is secondary.

A backdrop of stimulus to counter the impact of the pandemic remains a positive one for Bitcoin and other cryptocurrencies, according to Seamus Donoghue, vice president for sales and business development at digital infrastructure provider Metaco.

At the same time, JPMorgan Chase & Co. strategists have said US$40,000 is a key level for Bitcoin, flagging the risk of a further drop unless it climbs back above that price soon. Bitcoin has declined 8 per cent from the Jan. 8 record, raising the prospect of an exodus of speculative investors.

The Ethereum blockchain is popular for so-called decentralized finance and is also making progress toward a network upgrade. Commentators argue these trends have aided Ether.

Ether climbed 13.4 per cent to about US$1,400 as of 8:14 a.m. in New York. The Bloomberg Galaxy Crypto Index added about 14 per cent.

--With assistance from Mark Cranfield and Joanna Ossinger.