Mar 25, 2024

Bitcoin Volatility Becomes More Intense in US Compared With Asia

, Bloomberg News

(Bloomberg) -- Another day, another big swing in Bitcoin to enliven a relatively slow Monday on Wall Street. This time, the digital asset surged 7% to retake $70,000, the latest sign that pronounced Bitcoin moves increasingly fall in US hours.

That pattern was also evident in February after the token scaled $60,000 for the first time since 2021 and in the push to a record in March. The focus of trading has shifted to the US alongside the rollout of Bitcoin exchange-traded funds, which have drawn more than $11 billion in net inflows since their Jan. 11 debut.

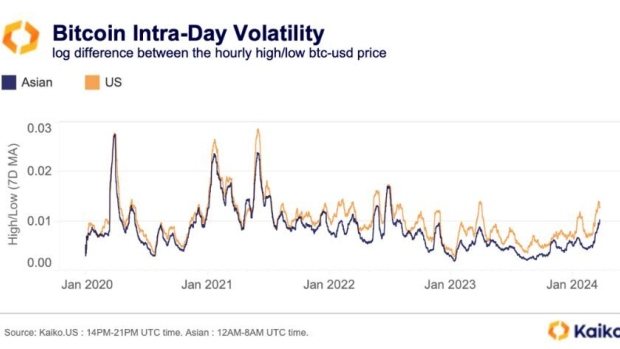

A metric tracking the difference between the high and low prices of Bitcoin each hour shows a bigger gap in the US versus Asia, research firm Kaiko said in note. Volatility has thus “been more concentrated during US opening hours,” it wrote.

The US Bitcoin funds from the likes of BlackRock Inc. and Fidelity Investments rank as among the most successful ETF launches and are altering crypto market structure. The changes include improved Bitcoin market liquidity and a spike in spot volumes around the time the ETFs calculate their net asset value toward the close of the US trading day.

In contrast, Asia appeared to be the new center of gravity for digital-asset markets for a time in 2023, during the height of a US crackdown on crypto. Back then, Bitcoin trading activity was becoming more intense in Asian hours.

Bitcoin was little changed at $70,390 on Tuesday in New York. The oldest cryptocurrency briefly punched past $71,000 in the US on Monday before gains cooled a little to roughly 7% for the session. The token is up 154% over the past 12 months and close its mid-March peak of almost $73,798.

--With assistance from Sidhartha Shukla.

©2024 Bloomberg L.P.