May 31, 2019

First-quarter stall masks underlying strength in Canada's economy

, The Canadian Press

Business investment, household spending drive Canadian GDP growth in Q1

Canada’s economy stalled for a second straight quarter, but the weak overall performance was driven by falling exports and masked strong gains in household spending and investment that suggest the nation’s expansion is poised to pick up speed.

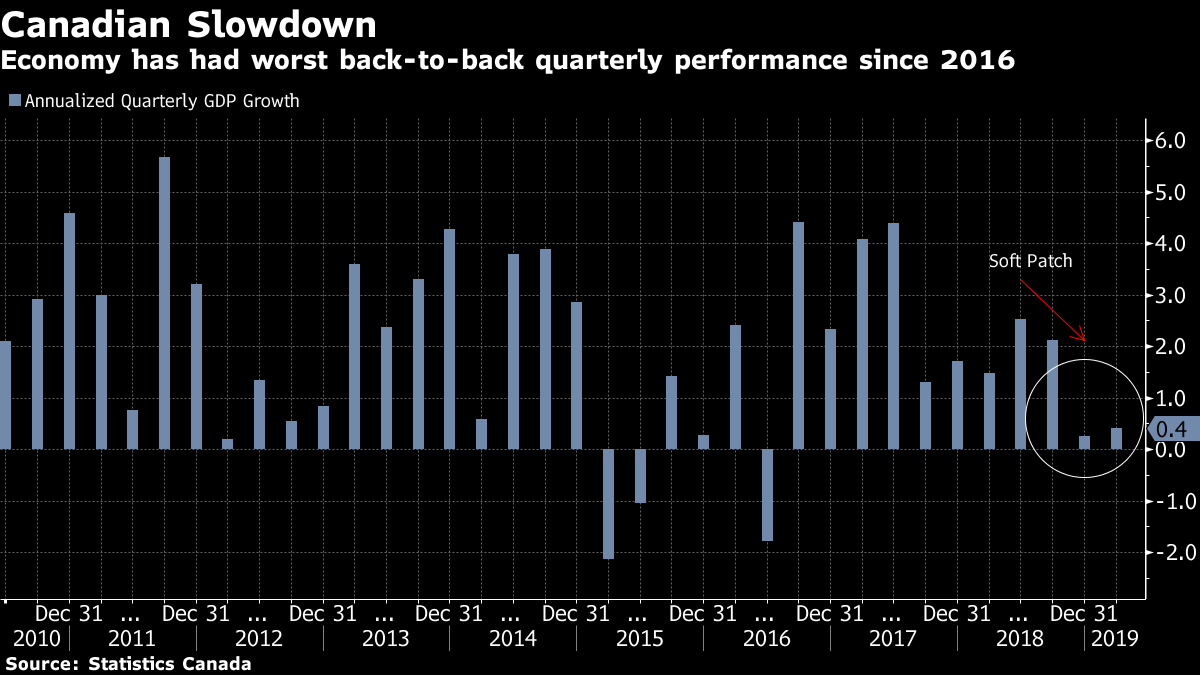

The economy grew by just 0.1 per cent in the first quarter, for an annualized pace of 0.4 per cent, Statistics Canada said Friday from Ottawa. That’s little changed from a 0.1 per cent quarterly (0.3 per cent annualized) reading in the final three months of 2018. Output was dragged lower by the biggest drop in exports in a year and a half.

Yet outside of the trade sector the report was strong, with both consumption and business spending making big comebacks. Non-residential investment jumped 13.5 per cent on an annualized basis, the biggest gain since 2010, while spending by households rose at the fastest pace in almost two years. The quarter also ended with a bang, with gross domestic product jumping 0.5 per cent in March, the biggest gain in 10 months.

The data support the Bank of Canada narrative on underlying strength in the economy despite the recent soft patch and that the slowdown will be temporary, with growth set to accelerate in coming months. The final reading for the first quarter was in line with the central bank’s forecasts, though it came in below economist expectations for annualized growth of 0.7 per cent.

“For Canadian growth, today was a case of out with the bad news, in with the good news,” Avery Shenfeld, chief economist at CIBC World Markets, said in a note to investors.

The Canadian dollar pared loses after the report, but remained down 0.2 per cent to $1.3534 per U.S. dollar at 8:49 a.m. in Toronto trading.

The Bank of Canada forecast growth will accelerate to an annualized 1.3 per cent in the second quarter, and pick up further in the second half of this year, before accelerating back to above 2 per cent growth by 2020.

At the very least, the numbers suggest that heightened uncertainty -- everything from the impact of higher interest rates to potential trade wars and oil-sector woes -- has begun to fade.

There are signs consumers are still spending even amid concerns over bloated debt loads --helped by easing rates on loans, strong job gains, stabilizing housing markets and improving financial markets.

Household spending was up an annualized 3.5 per cent in the quarter, after growing at the slowest pace in almost four years at the end of last year. Business investment was even stronger, after falling for three straight quarters. As a result, domestic demand posted its first gain --3.4 per cent annualized -- for the first time in three quarters.

“When you’re looking at the various components, it’s actually very good results,” Benoit Durocher, senior economist at Desjardins Financial Group in Montreal, said by phone. “You have a rebound in domestic demand which is quite good.”

Canada’s trade sector continues to be a major drag. The decline in the first quarter followed largely flat gains in the previous six months. But even here, trade data reported earlier this month suggested March was much better for exporters -- boding well for the second quarter.

In fact, industry specific data released Friday suggest much of the weakness in the first quarter was confined to energy -- because of curtailed oil production in Alberta -- and construction. The mining and oil and gas sector was down 4.1 per cent in the first quarter, the largest drop since 2016. Construction recorded a 0.5 percent drop in the three-month period. Sixteen of 20 industries saw higher production.

Other Details

A build-up in inventories was another major contributor to growth, contributing 0.7 percentage points to the change in GDP. The Bank of Canada has cautioned the increase in stockpiles could dampen production in coming months Rising oil prices during the quarter helped generate a much larger gain in real gross national income, which was up 0.9 per cent in the three month period. Housing investment remained soft, dropping 1.6 per cent. One reason for the discrepancy between the gain in domestic demand and GDP is that many of the goods purchased were imported. Import volumes rose 1.9 per cent in the first quarter.