Mar 22, 2024

Crypto Job Listings Are Rebounding With the Market Recovery

, Bloomberg News

(Bloomberg) -- Thanks in part to the digital-asset market’s recovery, crypto companies are hiring again, although in a more subdued manner than during the last crypto boom — at least for now.

Coinbase Global Inc., which recently returned to profitability, is looking to fill 200 positions worldwide. Rivals exchanges Kraken, Binance and Gemini are hiring as well, and so are some traditional companies such as Fidelity that have expanded their efforts in the sector. Many crypto startups are now able to raise funding once again, and can finally afford new hires, according to a slew of specialized jobs boards that are seeing surging demand.

CryptocurrencyJobs.co said it had seen a 50% increase year-over-year in job postings between January and February, and a further 45% rise in March. CryptoJobsList said it’s seeing almost double the number of jobs ads in March so far versus a year ago. Blockchain Association, which represents more than 100 of the industry’s biggest companies, lists more than 1,700 postings, up from fewer than 1,000 a year ago. During the peak of the 2021 bull market, it had more than 3,000 ads.

“Things are turning around,” said Dan Spuller, senior director of industry affairs at the association, which started seeing an uptick at the end of last year. “I would predict the rest of this year and certainly next year are going to be very strong. Our industry is unique, it correlates often with the overall market.”

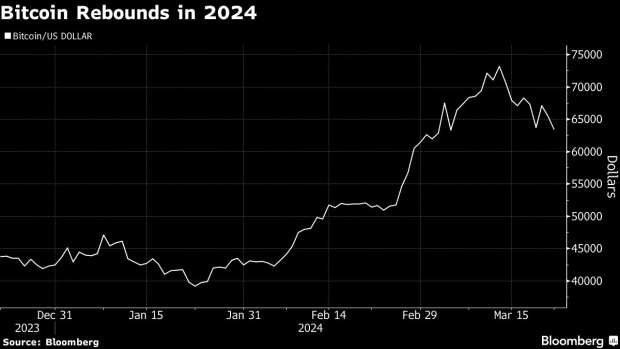

Industry bellwether Bitcoin hit a series of all-time highs this month, capping a more than 50% rally since January. Business is picking up across exchanges, as retail investors are returning into the market, lured, once again, by promise of skyrocketing returns. Coinbase’s shares closed at a 52-week high of $262 on Thursday.

“Kraken has successfully navigated several bull and bear markets while remaining prepared to scale around true inflection moments,” said Pranesh Anthapur, the exchange’s chief people officer. “The recent surge in crypto markets reinforces our existing thesis that 2024 is the right time to grow in order to meet the demand ahead of us.” The exchange currently lists more than 100 positions on its jobs site.

Fidelity is looking to fill 22 crypto-related positions, including a trader of digital assets and vice president of crypto investment risk. BlackRock Inc. — the world’s biggest asset manager that launched an exchange-traded fund investing directly into Bitcoin in January — mentions digital assets in dozens of jobs ads, including one for a vice president of digital assets and ETF legal counsel.

Business development jobs that were the first to get axed in the last downturn are the first to pick up speed now, Spuller of the Blockchain Association said.

Many of the companies hiring now, such as Coinbase, went through at least one round of layoffs during the crypto downturn of the past two years, and they’ve vowed to not over-hire again.

“We do plan some modest investment in headcount in 2024,” Alesia Haas, Coinbase’s chief financial officer, said in a February interview.

Following several years of falling prices and implosion of a slew of crypto businesses, including Sam Bankman-Fried’s FTX exchange and lenders Genesis and Celsius Network, the jobs recovery is still choppy. Indeed and LinkedIn say their crypto-related jobs ads are still down from year-ago levels.

What’s for certain is that there’s no shortage of applicants for the jobs, some of which can pay employees in crypto.

“There’s much talent looking for work, and there’s been an increased interest in working in crypto due to the bull market, so many listings on Cryptocurrency Jobs are getting hundreds of applications,” said Daniel Adler, the site’s founder. “It’s still very much an employers market.”

--With assistance from Elijah Nicholson-Messmer.

(Adds a chart on job listings.)

©2024 Bloomberg L.P.