Jun 8, 2022

Cut Taxes Before Economy Grinds to a Halt, OECD Warns UK

, Bloomberg News

(Bloomberg) -- The UK should cut taxes to support the economy before growth grinds to a halt next year, the OECD urged.

In its bi-annual economic outlook, the club of rich nations said recent increases in income and business taxes will prove “contractionary” and contribute to a slowdown that will see gross domestic product fail to advance in 2023.

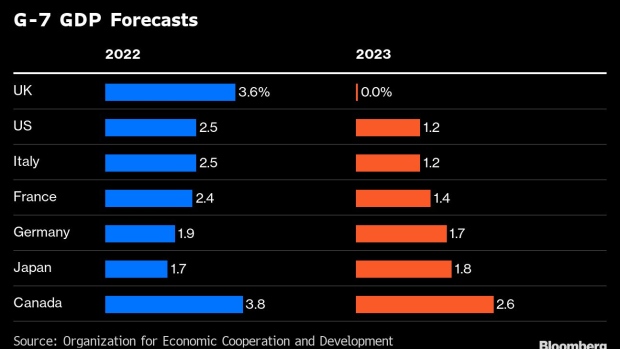

The economy will expand 3.6% this year -- the second-fastest rate among the Group of Seven advanced nations after Canada -- before sinking to the bottom of the pack. Every other G-7 country will grow by more than 1% in 2023, the OECD forecasts.

The deteriorating outlook comes with Prime Minister Boris Johnson still under pressure, despite winning a confidence vote this week in his leadership. Some lawmakers from his Conservative Party were already calling for the government to protect households from an escalating cost-of-living crisis by easing the overall tax burden from a 70-year high.

The turmoil around Johnson is fueling speculation that he may replace Chancellor Rishi Sunak, who’s raised taxes since taking over the Treasury two years ago. Sunak is expected to cut business levies in his fall budget and has vowed to trim income taxes.

Support may be needed. The OECD blamed “depressed demand” for the souring projections, predicting inflation will peak at more than 10% at the end this year -- up from 9% now, and still be 4.7% at end-2023. To tackle faster price growth, the Bank of England will need to raise interest rates to 2.5% from 1%, it said.

Households will take on debt to “to keep up with the rising cost of living,” while businesses will cut investment in the face of higher borrowing costs, the OECD said.

The London-based Centre for Economics and Business Research has estimated that 9 million workers will be dragged into higher income-tax brackets over the next four years if inflation remains elevated.

The OECD called risks to its outlook “considerable.” Spillovers from economic sanctions on Russia or a new Covid-19 outbreak could deliver another economic blow, while more-persistent inflation or labor shortages could lead to production shutdowns, it warned.

Both monetary and fiscal policy are “becoming restrictive,” the OECD said. “Fiscal policy has to balance gradual fiscal tightening with well targeted support to protect vulnerable households from the rising cost of living and significant spending and investment needs to support productivity.”

©2022 Bloomberg L.P.