Jun 13, 2018

ECB Should Seize the Day and Call Time on QE

, Bloomberg News

(Bloomberg Opinion) -- Thursday's European Central Bank policy meeting poses a dilemma for President Mario Draghi: whether to announce the timetable to end quantitative easing even though the bloc faces serious political problems, or fudge the outlook for bond purchases in case more stimulus is needed, thereby alienating a huge swathe of the Governing Council which risks losing control of the debate.

The region’s bond market can survive the first choice. The second? That’s complicated.

Forty-six percent of economists surveyed by Bloomberg News in early June say the end date for purchases will be announced in July. That’s up from 28 percent in the previous poll. It looks like the drama in Italian debt provoked the change, and to be fair, from a monetary perspective, whether the timing gets announced this month or next makes little difference.

But it’s important for investor sentiment. So it is hard to see any benefit to delaying any decision -- if the central bank is going to end QE this year it should just get on with it.

Policy makers’ communications have clearly shifted toward discussing ending bond purchases. It’s not just the hawks; once the normally dovish Chief Economist, Peter Praet, says a discussion is warranted, that looks nailed on.

The Bank of England provides a lesson in the costs of backpedaling. Governor Mark Carney’s communications whipsaw was a nasty shock for markets. Having set up investors up for a timetable, a delay by Draghi risks creating the European version of Ben Bernanke’s 2013 taper tantrum, an event which exactly no one should want to revisit.

There’s also a window of political opportunity. The Italian bond market has recovered somewhat from the populist whirlwind, but that could change as the September budget negotiations approach. Concerns about Greece’s fourth bailout haven’t broadly arisen, though the Eurogroup meeting later this month could raise some issues. This is as calm as it’s likely to get.

The bank’s own revised forecasts could well support an important step toward withdrawing stimulus. If the estimate for inflation in the first quarter of 2021 hits the bank’s target of below but close to 2 percent, then discussing the end of QE now seems, at the very least, reasonable. The recovery in much of the euro area is strong enough that some countries simply don’t need help in the bond market anymore – if they ever did in the first place.

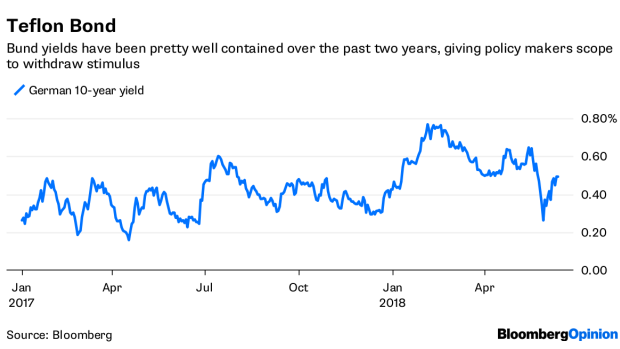

Taking this momentous step of calling the end to bond purchases carries some risks. Announcing the timetable would clarify that the central bank put is on its deathbed, and that could drive the region’s yields a bit higher.

But any selloff should be limited. The ECB will still be plowing funds back into the market through redemptions, not to mention that it looks pretty well certain that purchases will be extended to the final three months of 2018, though the pace will be less than the current 30 billion-euro monthly rate.

With the hawks on the panel pushing for definitive action on bond purchases, the most prudent course for Draghi would be to maintain unity by resolving the QE debate now. A benefit of doing so is that the spotlight will shift from monetary policy back onto politicians, and their progress (or lack of it) in addressing fiscal policy rather than relying on the central bank to do all the heavy lifting to solve the region’s problems.

The bank still retains significant tools that can be deployed with better focus to assist troubled countries, rather than simply buying government bonds across the board. The ECB should stick to its guns, announce the timetable, and spare the bond market a summer of dithering.

To contact the author of this story: Marcus Ashworth at mashworth4@bloomberg.net

To contact the editor responsible for this story: Jennifer Ryan at jryan13@bloomberg.net

©2018 Bloomberg L.P.