Hong Kong Developer Weighs Stake Sale in London Office Skyscraper Project

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Zhao Xiaowei did what would have been unthinkable just a few years ago: He quit his Beijing barista job and returned to his northeastern rust-belt hometown for a better future.

Sep 13, 2020

, Bloomberg News

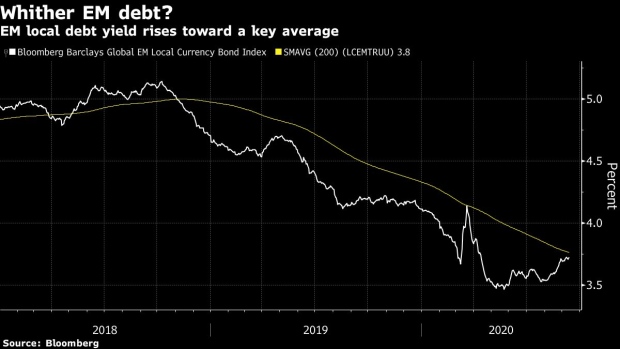

(Bloomberg) -- September is shaping up to be the month when the dial on the interest-rate compass no longer pointed so markedly south for the world’s developing economies.

Of the six major emerging-market central banks due to decide policy in the coming week, only one -- South Africa’s Reserve Bank -- is forecast to lower borrowing costs, extending a pattern that saw Malaysia, Peru, Ukraine and Chile keep rates unchanged this month.

The diminishing willingness of policy makers to reduce interest rates -- not to mention their scope to do so -- underscores the growing recognition across the developing world that after the wave of stimulus thrown at these economies amid the Covid-19 pandemic, inflation is edging up again. It’s a realization illustrated by a surge in demand for emerging-market inflation-linked bonds, which has driven yields on some notes to all-time lows.

For BNP Paribas SA, the absence of a strong carry story as the policy-easing cycle comes to an end means the focus must be on finding value. The bank is cutting its exposure to Brazilian rates and credit while reducing its allocation in developing-nation sovereign credit to almost zero in its recommended model.

“Despite supportive financial conditions and ample dollar liquidity, the risk-reward of maintaining a substantial long allocation in emerging-market risk assets is no longer attractive,” Gabriel Gersztein, the Sao Paulo-based head of global emerging-markets strategy at BNP Paribas, wrote in a report. “We have now switched to a more selective approach, in which idiosyncratic factors and political events play an increasingly important role in our trading choices.”

And there are plenty of country-specific risks to consider. Moody’s Investors Service on Friday cut Turkey’s debt to the lowest grade it’s ever given the country, warning of a possible balance-of-payments crisis. In Peru, President Martin Vizcarra is pushing back on an impeachment attempt that made the sol last week’s biggest decliner in emerging markets. And Russian President Vladimir Putin, grappling with the fallout from the alleged poisoning of opposition leader Alexey Navalny, is tightening his embrace of Belarus President Alexander Lukashenko as the dictator intensifies a crackdown on protests.

Emerging-market stocks ended a bad week on a high note Friday amid a selloff in U.S. tech stocks. Indexes of currencies and bonds were little changed as some investors geared up for the Federal Reserve’s two-day policy meeting starting Tuesday.

South Africa to Cut

Bank Indonesia is expected to stand pat Thursday as pressure remains on the nation’s currency

Taiwan’s central bank is also likely to remain on hold Thursday

Brazil’s central bank will probably keep the key policy rate unchanged at 2% Wednesday, and investors will analyze the recently established forward guidance for clues on how long rates will remain at a record low

Turkey’s Troubles

Other Data and Events

China is expected to report on Tuesday the recovery in industrial production accelerated in August from a year earlier, along with some improvements for retail sales and fixed assets investment

©2020 Bloomberg L.P.