Jan 16, 2020

Gold’s Rally Helps Miners Delay the Inevitable

, Bloomberg News

(Bloomberg Opinion) -- Peak gold production is looking a little more distant.

Global supply of the yellow metal has been inexorably approaching its high-water mark, as ore is extracted faster than new discoveries are made. Mines have been aging fast. A sustained price rally can change that picture, as investors rekindle their enthusiasm for large-scale exploration and technological innovation. Bullion miners’ margins will benefit.

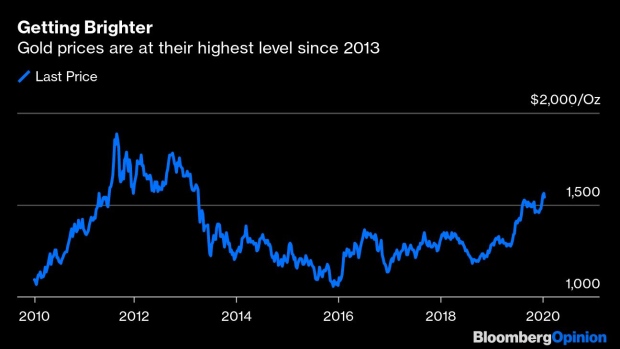

Gold is coming out of a long period in the investor wilderness. Last year marked the biggest annual gain in prices since 2010. It broke through $1,570 last week — the highest in almost seven years. Gold prices are driven by factors that aren’t always predictable, but there’s certainly scope to go higher, with interest rates low and geopolitical tensions simmering. Holdings of gold in exchange-traded funds, popular with retail investors, are near 2012’s lofty levels. Central banks remain buyers too.

This isn’t a repeat of 2011, when gold cracked a gravity-defying $1,900 per ounce — at least, not yet. The all-time high remains some way off, despite a handful of analysts already pointing to $2,000 gold.

But the impact of higher prices is already trickling down. All-in sustaining cash costs remained at around $934 per ounce for the largest producers in the third quarter of 2019, according to Bloomberg estimates. The industry measure, though rising, makes for healthy margins. Barrick Gold Corp., for example, reported third-quarter free cash flow of $502 million, compared to $55 million in the previous three months.

Last year’s flurry of M&A speaks to that exuberance: from Barrick Gold’s merger with Randgold Resources Ltd., completed that January, to Goldcorp Inc.’s union with Newmont Corp., plus a string of opportunistic offers among smaller companies, and imaginative deals like Barrick’s Nevada joint venture with Newmont. Overall, 2019 marked a return to levels last seen during the boom.

There’s more to come, especially among smaller players. Diverging levels of bullishness, after years of homogenous forecasts, will create opportunities for miners to expand portfolios.

But the deal spike tells a supply story too, and those numbers are grim even after miners pair up, with reserves down steadily for much of the past decade. The average life of a gold mine shrank to 11 years by 2018 from 16 in 2012, according to consulting company Wood Mackenzie Ltd. Back in 2015, as prices fell toward $1,000 an ounce, the World Gold Council warned that the industry was nearing “peak gold,” after which output would begin to decline. That’s still a threat.

Tie-ups are no panacea. The trouble is there’s no short-term link between gold prices and supply. Sure, marginal projects become viable, but that’s a transient boost. Also, the lag effect means mines commissioned in boom years will still take years to come into production. Meanwhile, the scars of the 2011 excesses will make miners reluctant to change their assumptions for the long-term gold price, which are largely still at or below $1,300.

The good news is that this works both ways. Higher supply, through exploration or innovation, also won’t depress prices.

That should increase enthusiasm for exploration. Budgets have shrunk and success rates have been decreasing, even if gold continues to command the lion’s share of the mining sector’s exploration outlays. So far, spending has increased largely on existing projects rather than new finds. Splashy budgets don’t guarantee success, but the supply numbers will have to rise. There are already signs of long-awaited projects accelerating, such as Polyus PJSC’s Sukhoi Log in Siberia.

Then there is investment in technology. This isn’t only to automate and electrify fleets, but to upgrade exploration and processing techniques. For gold, processing improvements could make even complex, refractory ore — resistant to more common extraction methods — attractive. Barclays Plc estimated in December that innovation could add 10% of incremental supply growth through 2025. Cost per ounce may come down 4%. That’s a target worth aiming for.

To contact the author of this story: Clara Ferreira Marques at cferreirama@bloomberg.net

To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Clara Ferreira Marques is a Bloomberg Opinion columnist covering commodities and environmental, social and governance issues. Previously, she was an associate editor for Reuters Breakingviews, and editor and correspondent for Reuters in Singapore, India, the U.K., Italy and Russia.

©2020 Bloomberg L.P.