Dec 27, 2021

Indonesia Pledges to Return to 3% Fiscal Deficit Limit by 2023

, Bloomberg News

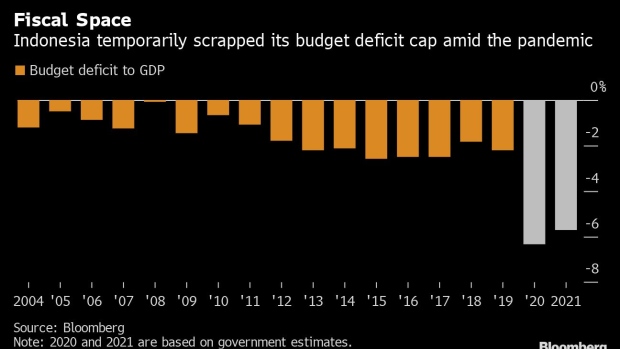

(Bloomberg) -- Indonesia’s government will keep its promise to gradually reduce the budget deficit and return to fiscal discipline, after it had to raise the deficit cap this year amid the coronavirus pandemic, a top economic official said.

The government will lower the funding gap next year and restore the deficit cap of 3% of gross domestic product by 2023, Febrio Kacaribu, head of fiscal policy at the Finance Ministry, said in an interview in Jakarta. Indonesia waived the deficit cap this year via an emergency law because of the pandemic, widening this year’s projected deficit to 6.3% of GDP.

“We look at it very carefully, and we’ve done our math,” Kacaribu said. “Is going back to 3% achievable? Yes.”

The government expects Southeast Asia’s largest economy to contract by as much as 2.2% this year before returning to 5% growth in 2021. The budget deficit for 2021 is set at 5.7% of GDP, but President Joko Widodo recently said Covid-19 vaccines will be provided to the population for free, potentially increasing the burden on government coffers.

Indonesian policy makers see a return to fiscal discipline as an important priority, as it boosts confidence among investors in the country’s sovereign bonds and is highly valued by credit rating companies.

“We have created quite an achievement in terms of macro stability, and it has also served our policy makers as a good guideline,” Kacaribu said, referring to the deficit cap. “We’d still like to see that limit in place.”

Indonesia is well-positioned to unwind its fiscal stimulus after extensive spending during the pandemic on social protection, business restructuring and free vaccinations, said Wisnu Wardana, an economist at PT Bank Danamon in Jakarta.

“In our view, getting the fiscal deficit back on track is about discipline as well as prudence. But more importantly, it’s about credibility,” he said.

Japan Credit Rating Agency Ltd. affirmed Indonesia’s credit rating with a stable outlook on Dec. 22, citing the government’s commitment to getting the budget deficit back below 3% of GDP by 2023.

Boosting Tax

Kacaribu, 42, was appointed to the Finance Ministry in April just as the pandemic was rearing its head in the sprawling archipelago. Before that, he was head of research for macro and finance studies at the University of Indonesia’s Institute for Economic and Social Research.

One of the government’s greatest challenges in returning to fiscal discipline is tax collection, especially if a sluggish recovery limits tax payments from businesses and corporations.

Through end-November the Finance Ministry had met just 77% of this year’s tax-revenue target, down more than 18% from last year’s pace. It’s not only due to the recession: Lower corporate-tax rates, as well as various fiscal incentives offered during the pandemic, have pressured tax revenues.

Reforms may be necessary to improve Indonesia’s tax ratio, which -- at less than 10% of GDP last year -- is low compared to regional peers. Kacaribu said sectors like agriculture have yielded only a small amount of tax revenue relative to their weight in the economy. Some health and education services used by higher-income Indonesians also could be taxed more.

“We’d like to see the possibility of increasing tax rates or the tax base for some sectors, but we’ll do it very carefully,” Kacaribu said, adding that the economy is likely to remain fragile for several years after the pandemic.

Digital Taxes

Since July, Indonesia has been imposing value-added tax on digital goods and services. The government will wait for a global consensus before starting to collect income tax on digital companies.

The Finance Ministry also is gearing up for broad financial-sector reform next year via an omnibus law. The changes aim to deepen Indonesia’s financial markets, whose assets and investments are dwarfed by those in other countries, according to Kacaribu.

“We need to make sure that our financial sector can actually serve as intermediation between the surplus and deficit side of the economy,” he said.

©2020 Bloomberg L.P.