Aug 10, 2020

Michelle Wearing's Top Picks: August 10, 2020

BNN Bloomberg

Full episode: Market Call for Monday, August 10, 2020

Michelle Wearing, associate portfolio manager at Starlight Capital

Focus: Real estate stocks

MARKET OUTLOOK

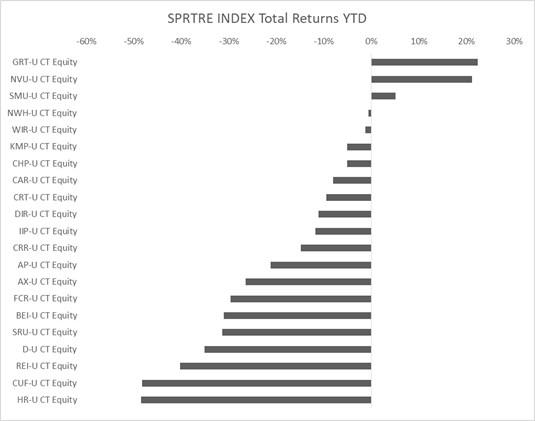

In our 2020 outlook we said it would be a year where stock selection would be the biggest driver of outperformance, and boy were we right! The bifurcation of performance in the REIT sector has been dramatic and caught many passive investors offside. Unfortunately, we expect market volatility to continue as the threat of a second wave of COVID-19 remains, as well as other potential disruptors like the U.S. presidential election set for November, and U.S.- China tensions.

We believe this low growth, low interest rate, low inflation and significant fiscal stimulus is a formula for strong equity returns. We expect low interest rates and dividend cuts will exacerbate the demand for yield from investors. With global bonds yielding almost nothing, we expect to see significant capital chasing equities, like REITs, for yield. While many companies have suspended or reduced distributions, the Starlight Global Real Estate Fund has had sixteen distribution increases at an average of 6.8 per cent thus far in 2020 (and no cuts or suspensions).

The companies we primarily invest in generate high single-digit earnings growth combined with mid-single digit distribution yields, allowing potentially for double-digit returns without the need for multiple expansion. Our portfolio continues to be heavily focused on Industrial REITs, apartment REITs, and data centres and towers, as these sectors benefit from secular trends and are undersupplied. We do not have any direct exposure to retail REITs, as we believe the supply will continue to outweigh demand as the secular trends of e-commerce will have a negative impact on rents. We also do not own any seniors housing names, as we see a number of near-term risks with limited catalysts, which include oversupply of retirement residences, occupancy declines due to COVID-19, increased costs due to COVID-19, headline risk, and lawsuit risk. Lastly, we do not own anything in the hotel sector.

TOP PICKS

Safehold Inc. (SAFE NYSE)

Safehold (SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Through its modern ground lease capital solution, SAFE helps owners of high quality multifamily, office, industrial, hospitality and mixed-use properties in major U.S. markets generate higher returns with less risk. A ground lease (typically ranging from 30-99 years) represents ownership of land that is underlying commercial real estate properties, and it is considered to have the most senior position in the capital stack.

SAFE is the only public REIT to focus exclusively on ground leases, and with a total addressable market of approximately US$7 trillion, we believe the company remains well positioned for outsized growth vs. the broader REIT space over the next several years. Since its IPO in June 2017, SAFE’s portfolio has grown approximately 8 times. The strength and quality of SAFE’s portfolio through diversification and seniority is exemplified by the level of its rent collections during the peak of the COVID-19 pandemic where SAFE collected 100 per cent of cash rent due in Q2 2020, generated 39 per cent EPS growth, and raised the dividend 4 per cent.

We believe SAFE is significantly undervalued due to the street’s valuation using traditional real estate methodologies such as NAV. We argue that because SAFE’s underlying cash flow stream has a weighted average lease term of 89 years, the most appropriate comparable is not a REIT, but rather a long-term 100-year bond. While the initial yields on a AAA 100-year bond and SAFE’s ground leases are very similar, SAFE has the benefit of lease escalation (2 per cent per annum), which drives the effective YTM to 5.5 per cent, while the YTM for the bond remains at 3.0 per cent for the life of the bond. Portfolio with contractual rent increases creates long-term compounding cash flows that generate superior returns versus similar risk and similar maturity fixed income securities

Alexandria Real Estate Equities Inc. (ARE NYSE)

Alexandria Real Estate Equities Inc. is the only publicly-traded REIT focused solely on the life science space. Alexandria is benefitting from growth in space demand for treatments and cures related to both COVID-19 and other diseases.

Although Alexandria is considered an office REIT, we argue that it is very different, notably that many of its tenants cannot work-from-home. Collections remain high at an impressive 99 per cent of July rents, as healthcare and life sciences are deemed essential and other tenants are generally larger and well capitalized. Alexandria was able to lease over 1 million square feet in Q2 (consistent with prior quarters) at rents approximately 15 per cent higher, versus office leasing which essentially came to a standstill because of COVID-19.

We believe a premium valuation is warranted given Alexandria’s strong gateway markets, Class A assets, niche tenants, well-leased portfolio, lower capex levels resulting from a newer portfolio of assets, strong growth profile with a significant development pipeline, as well as comfortable leverage levels.

Minto Apartment REIT (MI-U TSX)

Minto Apartment REIT (Minto) owns arguably the highest-quality residential portfolio of the Canadian apartment REITs, located in urban markets like Toronto, Ottawa, Montreal, Calgary, and Edmonton. Minto was spun out in 2018 by its private equity parent company the Minto Group, who owns approximately 41 per cent of the REIT.

We view Minto’s current unit price as very attractive, trading at a 24 per cent discount to its Net Asset Value versus its closest peers at 10 per cent discounts and its long-term average of a 6 per cent discount. We believe the recent underperformance is an overreaction to Minto’s urban portfolio amid concerns of people moving to the suburbs because of COVID-19 and prolonged work-from-home. We argue that Minto’s current portfolio rents are on average 13 per cent below market, which will translate into significant growth on suite turns. We expect Minto will raise the distribution with their Q2 results on Tuesday night, signaling the Board’s confident in Minto’s future cash flows.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| SAFE | N | N | Y |

| ARE | N | N | Y |

| MI-U | N | N | Y |

PAST PICKS: August 22, 2019

Granite REIT (GRT-U TSX)

Then: $63.25

Now: $78.35

Return: 24%

Total return: 29%

American Homes 4 Rent (AMH NYSE)

Then: US$25.65

Now: US$29.10

Return: 13%

Total return: 14%

Hudson Pacific Properties (HPP NYSE) – SOLD MARCH, 2020

Then: US$33.71

Now: US$23.99

Return: -29%

Total return: -26%

Total return average: 6%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| GRT-U | N | N | Y |

| AMH | N | N | Y |

| HPP | N | N | N |

Website: www.starlightcapital.com