Jun 29, 2020

Micron's bullish revenue forecast sparks share surge

, Bloomberg News

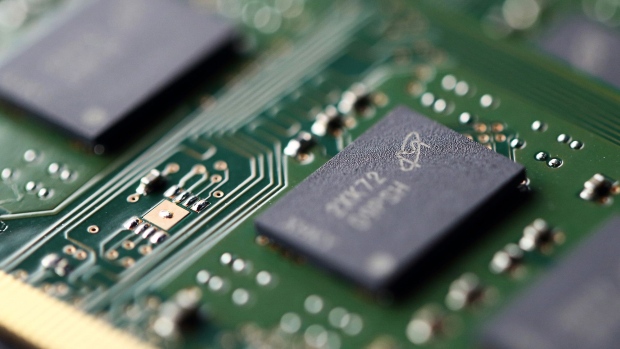

Micron Technology Inc., the largest U.S. maker of computer memory chips, gave a strong forecast for the current period suggesting demand is recovering as parts of the global economy emerge from the pandemic lockdown. The shares jumped in extended trading.

Revenue in the current period will be US$5.75 to US$6.25 billion, the Boise, Idaho-based company said in a statement. That compares with an average analyst estimate of US$5.5 billion.

Micron makes memory chips for computers, and similar components that store data in mobile devices. The company competes with Samsung Electronics Co., SK Hynix Inc. and Kioxia.

The COVID-19 pandemic has sparked a deep recession and dented consumer demand for the tech gadgets that use Micron chips. However, millions of people are working from home and going online more. That has spurred demand for Micron components in servers that power much of this digital activity.

In May, the company lifted its revenue guidance due to this data-centre boom. However, it also cautioned that overall demand was still weaker than at the beginning of the year and warned that the economy may deteriorate in the second half of 2020.In Micron’s fiscal-third quarter, net income was US$803 million, or 71 cents US a share, down from US$840 million, or 74 cents US a share, in the same period a year earlier. Revenue was US$5.43 billion, a gain from a year ago. Wall Street was looking for earnings of 65 cents US a share and sales of US$5.3 billion.

“Micron’s exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment,” Micron Chief Executive Officer Sanjay Mehrotra said in the statement.

Some analysts see the virus lockdown helping Micron and its peers. Some chipmakers have struggled to get all the machinery they need to equip new production lines. That has slowed output gains and may limit supply while supporting prices, they argue.

Micron’s stock rallied more than six per cent in extended trading after the report. It earlier closed up 1.4 per cent at US$49.15. That left the shares down about nine per cent so far this year, compared with a five-per-cent gain by the Philadelphia Semiconductor Index.