Jan 1, 2020

Mixed Start Seen as 2020 Trading Gets Underway: Markets Wrap

, Bloomberg News

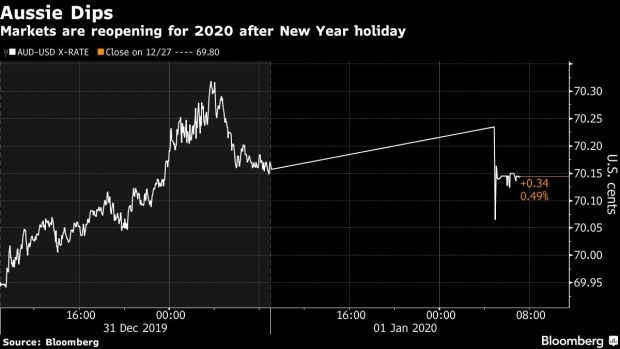

(Bloomberg) -- Traders eyed a cautious start on Thursday in Asia as they assessed the latest policy move by China’s central bank and awaited data on the country’s manufacturing sector. Australia’s dollar and the yen edged lower.

Activity is set to pick up as most global markets reopen from holiday closures on Jan. 1, though Japanese equities remain shut for the remainder of this week. The People’s Bank of China on Wednesday said it will increase the supply of cheap funding to banks, a move of policy support in line with market expectations.

Markets start this year on the back of a strong performance for global stocks and sovereign bonds in 2019. Thursday gives investors the latest read on Chinese manufacturing with the Caixin manufacturing PMI expected to hover around its November level — remaining well in the expansionary zone.

“One of the biggest risks today may be that stocks have already priced in much of the good news,” said Bob Doll, senior portfolio manager at Nuveen Asset Management. “Stock prices can still climb higher, but we don’t expect results anywhere near 2019.”

Meantime, investors are keeping an eye on North Korea. Kim Jong Un said he was no longer bound by his pledge to halt major missile tests and would soon debut a “new strategic weapon.”

Here are some events to watch for this week:

- China’s Caixin manufacturing PMI comes Thursday. The December figure is expected to come in at 51.6, according to a survey of economists, following a reading of 51.8 the prior month.

- Federal Open Market Committee minutes will be released on Friday.

- U.S. ISM manufacturing is due Friday. The Institute for Supply Management’s PMI is forecast to show a contraction for a fifth straight month.

These are some of the most recent moves in major markets:

Stocks

- The S&P 500 Index rose 0.3% on Dec. 31, when the Stoxx Europe 600 Index decreased 0.1%.

- Hong Kong’s Hang Seng Index fell 0.5% on Dec. 31.

Currencies

- The yen slid 0.1% to 108.72 per dollar.

- The Australian dollar dipped 0.1% to 70.14 U.S. cents.

- The euro traded at $1.1214.

Bonds

- The yield on 10-year Treasuries was at 1.92% in most recent trading.

Commodities

- West Texas Intermediate crude fell 1% to $61.06 a barrel on Dec. 31.

- Gold was at $1,517.29 an ounce.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Andreea Papuc

©2020 Bloomberg L.P.