Feb 17, 2021

Namibia Central Bank Holds Interest Rate at Record-Low 3.75%

, Bloomberg News

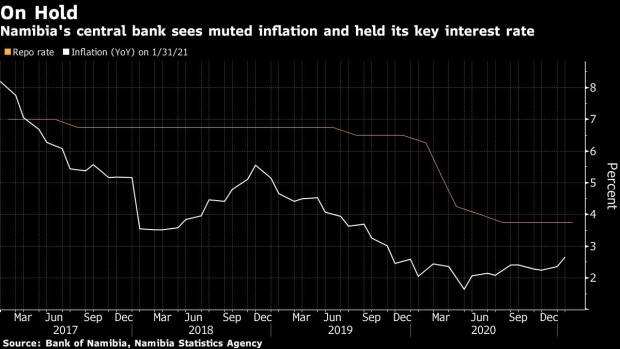

(Bloomberg) -- Namibia’s central bank held its benchmark interest rate at a record low in its first meeting of the year, striking a balance between supporting the economy and protecting its currency’s peg to the South African rand.

The monetary policy committee maintained the rate at 3.75%, Governor Johannes !Gawaxab told reporters Wednesday in the capital, Windhoek. It follows an unchanged decision by the South African Reserve Bank last month, and means Namibia’s benchmark rate remains higher than its neighbor’s.

With inflation quickened to the highest in more than a year in January the central bank sees it averaging 3%, this year, which is the lower end of the inflation target. The MPC sees the rate of price growth remaining lower for longer, said !Gawaxab.

The positive gap between the key interest rate and inflation will help the southern African country safeguard its currency’s peg with the rand and maintain inflows. If the central bank of the world’s fourth-largest producer of uranium cuts its rate to less than South Africa’s or moves before its neighbor does, investors could shift funds to benefit from higher returns.

International reserves were at 34.4 billion Namibian dollars ($1.9 billion) at the end of January compared with 29.9 billion Namibian dollars reported at the previous meeting. That’s enough to cover 5.3 months’ imports and sufficient to help maintain the currency peg, !Gawaxab said.

The central bank projects the economy will grow 2.6% this year.

©2021 Bloomberg L.P.