Dec 21, 2020

New Stimulus Tides Over U.S. Economy Without Being a Cure-All

, Bloomberg News

(Bloomberg) -- The $900 billion stimulus package agreed to by U.S. lawmakers over the weekend could keep the economy from contracting again, but pandemic-related risks remain if activity doesn’t start to bounce back next year.

The fiscal relief package includes $600 one-time checks to individuals, more funding for the Paycheck Protection Program and a 10-week extension of unemployment benefits, with each week supplemented by a $300 payment. Those measures -- which Congress may approve Monday -- could help prop up a U.S. economy that’s been deteriorating in recent weeks.

The relief is less than what Democratic Party lawmakers proposed, and President-elect Joe Biden’s administration will likely seek additional stimulus when he takes office in January.

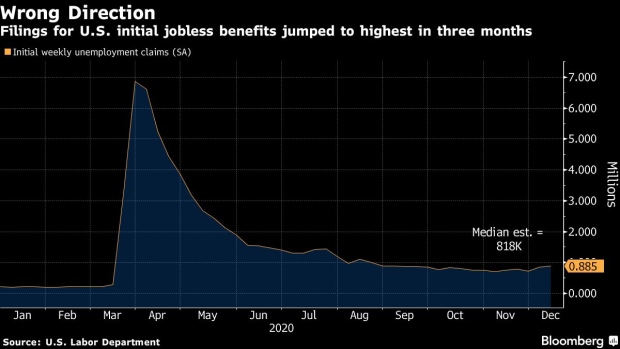

Initial jobless claims are at a three-month high, November’s payroll gains were well below expectations and retail sales declined in both October and November. The passage of additional fiscal support, combined with increasing numbers of Americans being vaccinated, means the economic recovery should be off and running by mid-2021, Mark Zandi, chief economist at Moody’s Analytics, said in a note.

The stimulus deal “has come just in time to forestall a double-dip recession,” Zandi said. The package will add approximately 1.5 percentage points to annualized real GDP growth in the first quarter of 2021, and about 2.5 percentage points to next year’s growth, he said.

Michael Feroli, chief U.S. economist at JPMorgan Chase & Co., said on Bloomberg Television that the relief package “should be very helpful for the economy,” and estimated that it could boost GDP by as much as 3% over time.

Still, many of the protections expire in the first quarter, meaning additional relief could be needed by March. While the Covid-19 vaccine rollout is expected to pick up by spring, the sectors most impacted by the pandemic are unlikely to approach full reopening until later in the year, Andrew Husby, economist at Bloomberg Economics, said in a note.

What Bloomberg’s Economists Say...

“The package directs aid where it is needed most. Along with a quicker-than-expected start to vaccine rollout, this is a key reason our 2021 outlook has been unchanged (3.5% expansion in gross domestic product for 2021), despite the package being slightly smaller than the baseline we have carried since the summer.”

-- Andrew Husby, economist

For the full note, click here

Lawmakers had been struggling for months to reach a deal, and for many Americans the new stimulus package didn’t come soon enough. The number of Americans out of work for the long term has more than doubled since August, and an increasing number of businesses are losing revenue or even closing permanently.

“This stimulus really is a stopgap, it’s come really late and it’s a little lame, honestly -- it’s not as big as I would have liked,” Megan Greene, a senior fellow at Harvard’s Kennedy School of Government, said on Bloomberg TV. “If we’d waited until the new administration had come into power, particularly if the Republicans control the Senate, then it probably would have been even smaller, so I think this was probably the best that we realistically could have hoped for.”

The rescue package doesn’t include aid to state and local governments, many of which are facing huge budget shortfalls. Without funding, they’ll be forced to cut jobs, programs and services at an inopportune time for the broader economy, Zandi said.

The passage of new fiscal relief will largely depend on the outcome of the Georgia runoffs, which will determine which party controls the Senate, said Jennifer Lee, senior economist at BMO Capital Markets.

Ultimately, the most important driver of the recovery will be increased economic activity, which is largely dependent on an effective vaccine, Lee said. While the stimulus package “kicks the can down the road” until March, there could still be challenges this winter, she said.

“There are going to be tons of negative headlines in the first quarter -- seasonally it’s weak anyway -- but because of these lockdowns you’re going to see further weakness,” she said.

©2020 Bloomberg L.P.