Aug 28, 2020

REIT investors get hit despite Canada's surging property market

, Bloomberg News

Bill Harris discusses Smart Reit

Canada’s private real estate market is roaring again after it briefly froze up because of COVID-19. Its stock market equivalent isn’t keeping pace.

Home sales and prices in the nation’s biggest cities have rebounded sharply. In greater Toronto, the average selling price of homes jumped almost 17 per cent in July over the previous year. A national home price index rose 7.4 per cent.

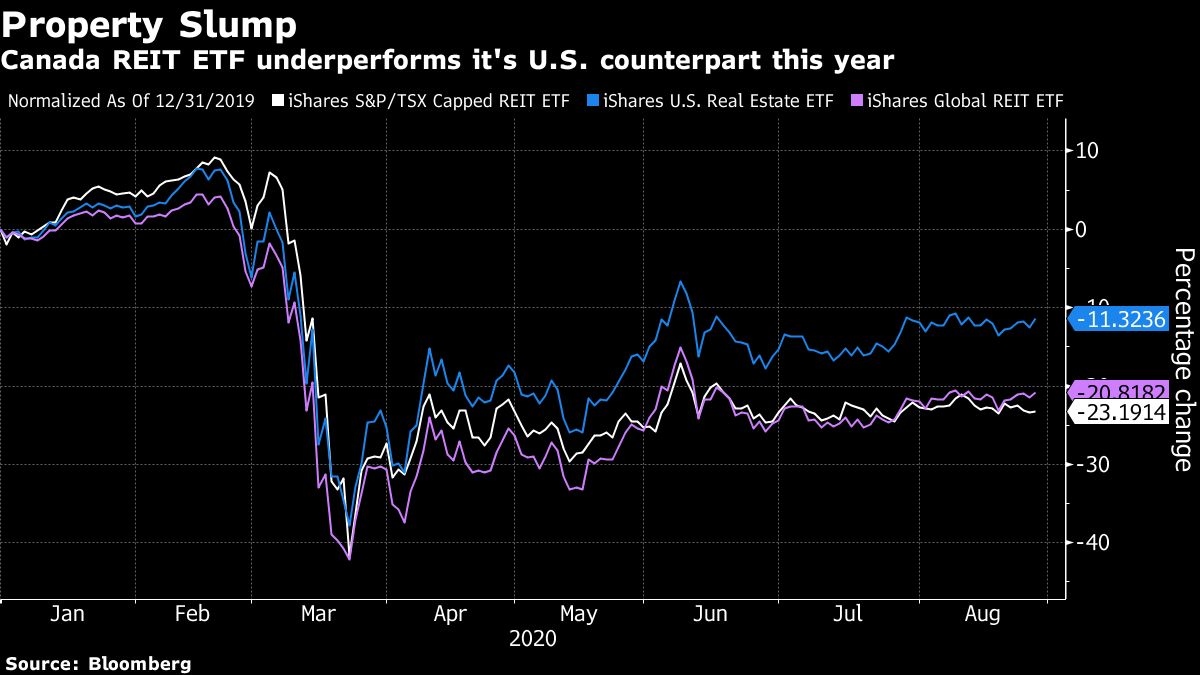

Investors who are getting their property exposure through equities, on the other hand, are having a dreadful time. The iShares S&P/TSX Capped REIT ETF, trading under the ticker XRE, is down 23 per cent this year, excluding dividends, underperforming its U.S. and global equivalents. The Canadian ETF is on pace for its worst year since the 2008 global financial crisis.

It’s a story of too much exposure in the wrong places. Canada’s commercial real estate sector boomed in the decade after the financial crisis, as global investors bid up urban office buildings and strong consumer spending made shopping centers valuable.

The coronavirus pandemic reversed the outlook for both office and retail, causing heavy losses for large Canadian REITs including RioCan Real Estate Investment Trust, Cominar REIT and H&R REIT.

“Retail is the largest weighting currently with just under 30 per cent of the XRE,” Matt Carvalho, chief investment officer at Cardinal Point Wealth, said by phone. “Certainly those have been hurt quite dramatically more -- and I think there’s more uncertainty around just how soon or how much of that retail space that we do need as people start moving more to online commerce.”

Canada’s REIT index also has little exposure to data centers, warehouses, mobile phone towers -- all growing in importance as the masses work and shop from home and wireless companies launch 5G services. The two top REIT holdings in the iShares U.S. Real Estate ETF (IYR) are American Tower Corp. and warehouse facilities owner Prologis Inc.

‘Utility-Like’ Assets

Specialized REITs make up 40 per cent of the U.S. ETF. “That’s a lot of those companies like American Tower or Prologis that have non-retail or non-office type exposure,” said Carvalho, who manages more than $1 billion (US$760 million) for U.S. and Canadian clients. Global diversification helps REIT investors avoid too much concentration in one slice of the real estate market, he said.

The shifting tides caught the attention of Brookfield Asset Management Inc. years ago. The firm is a large owner of office properties and other real estate, of course -- include One Liberty Plaza in New York and Toronto’s First Canadian Place. But in his latest quarterly letter to shareholders, Chief Executive Officer Bruce Flatt talked up the company’s large data infrastructure business.

Brookfield is one of the largest owners of wireless towers globally, has data centers in 14 countries and owns fiber networks, Flatt said. Such assets have utility-like characteristics, he added, especially now.

“The importance of these networks was further reinforced during the pandemic, as access to robust and reliable connectivity became a basic need for performing routine activities such as working from home, remote learning