Apr 26, 2024

Russia Oil Refining Curbed as Maintenance Follows Drone Strikes

, Bloomberg News

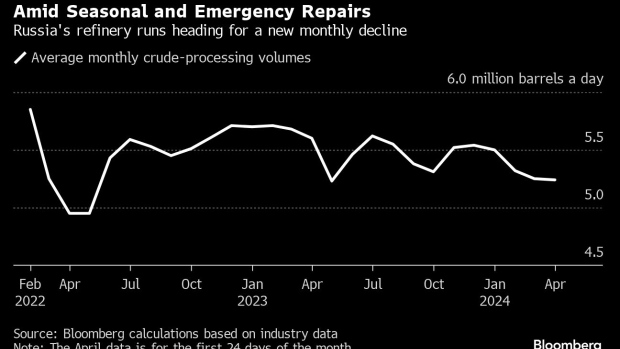

(Bloomberg) -- Russia’s oil-processing rates remain under pressure as refineries, which have barely recovered from drone attacks, enter seasonal maintenance.

Refineries processed 5.24 million barrels a day in the April 1-24 period, according to a person with knowledge of industry data. That’s down slightly from March, when rates capped a third monthly decline.

The downstream segment, one of the country’s most important industries, has been a target of Ukrainian drone attacks since late January, as Kyiv seeks to curb fuel supplies to the front line and cut the flow of petrodollars to the Kremlin’s coffers. Flooding in Russia’s Urals region earlier this month, as well as the start of seasonal repairs, have put additional pressure on processing rates.

Russia’s average refining rates totaled 5.27 million barrels a day in the seven days to April 24, about 0.8% above the previous week’s level, said the person, who asked not to be identified as the information isn’t public.

The drone attacks have targeted some of Russia’s key refineries, initially causing partial or complete shutdowns. But lately, anti-drone systems have given the nation’s refiners time to regroup, deploy spare capacities and start repairs at the affected units. Of the facilities hit, only Rosneft PJSC’s Tuapse facility remains completely offline, the person said.

Rosneft’s Ryazan plant, which was damaged by a drone in mid-March and has gradually recovered, processed more than 300,000 barrels a day in the April 18-24 period to exceed pre-attack levels, the person said.

Still, some other facilities hit by drones are still processing less than before the attacks, either due to seasonal maintenance or emergency repairs.

The independent Orsk refinery, which halted production due to floods earlier this month, has been returning capacity, the person said. Volumes at Lukoil PJSC’s Perm refinery have recovered by 14,000 barrels a day, according to the person.

Repairs Ongoing

Small independent Russian facilities, which have potentially started seasonal maintenance, lowered their combined crude throughput for April 18-24 by an average 55,000 barrels per day, the person said. That’s been a main driver of pressure on processing rates during the period.

Surgutneftegas PJSC’s major export-focused Kirishi refinery reduced processing by more than 28,000 barrels a day, while Rosneft’s Novokuybyshev cut refining by another 21,000 barrels a day. Both facilities have been curbing runs for several weeks, which may also signal planned works.

Gazprom Neft PJSC’s Moscow refinery, which started maintenance in late March, increased volumes by more than 65,000 barrels a day, the person said.

Rosneft, Lukoil, Gazprom Neft and Surgutneftegas didn’t immediately respond to Bloomberg requests for comments on oil-processing rates at their facilities.

©2024 Bloomberg L.P.