May 12, 2020

Sarepta Investors Buckle Up for Pfizer’s DMD Gene Therapy Update

, Bloomberg News

(Bloomberg) -- A fresh look at how a handful of patients are faring on Pfizer Inc.’s gene therapy for Duchenne muscular dystrophy will be key for investors in competitor Sarepta Therapeutics Inc.

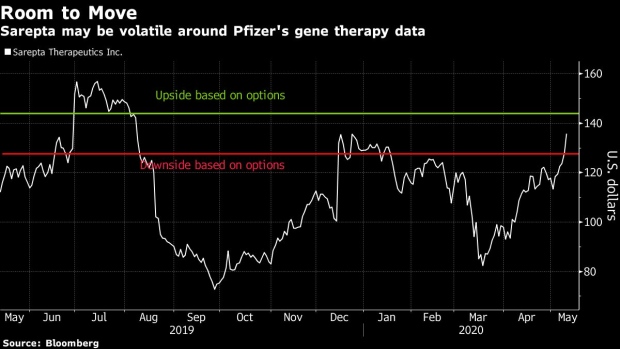

Underwhelming effectiveness or new safety issues in this week’s data could remove an overhang for Sarepta shares, which are on their longest winning streak since November. The update will be important in evaluating the competitive landscape before either company starts pivotal trials, wrote RBC Capital Markets analyst Brian Abrahams.

RBC expects Pfizer’s presentation at the virtual meeting of the American Society of Gene & Cell Therapy on Friday could trigger a 5% to 10% move in Sarepta shares. Duchenne muscular dystrophy is the core of the company’s pipeline. The two companies are roughly neck-and-neck in drug development for a one-shot therapy to treat patients with the condition, which is marked by progressive muscle weakness and an early death.

“We expect Pfizer’s presentation at ASGCT to show that its program is potentially active, though we also expect it could highlight the comparative disadvantages versus Sarepta’s program,” Abrahams said.

Analysts have said commentary on Pfizer’s quarterly earnings call reflected enthusiasm for the program, even though the abstract for the meeting contained no new data. “They believe they have seen signs of consistent efficacy on a variety of measures, including signs of functional improvement in some older boys where one would expect functional decline,” Mizuho analyst Vamil Divan wrote of Pfizer’s stance.

The commencement of Sarepta’s Study-301, a planned multicountry trial of its gene therapy with commercial-ready material which is key to securing regulatory approval, is likely to start in the second-half of the year after a few months of delay. While it is unclear when Pfizer could start its pivotal trial in the current environment, SVB Leerink analyst Joseph Schwartz said “investors will likely reward the first company out of the Phase 3 gates.”

Shares of Cambridge, Massachusetts-based Sarepta are trading 21% higher than they were 12 months ago, though they remain well off a July peak, as investors await updates for its gene-therapy portfolio. All but one of the 24 analysts tracked by Bloomberg recommend buying shares; the lone skeptic has a hold rating.

Options in Sarepta set to expire on Friday show expectations that shares are likely to move about 6% by the end of the week. Pfizer’s anticipated move is more muted with options only implying a 2.4% move over the next five days.

©2020 Bloomberg L.P.