Apr 26, 2024

SNB’s Jordan Warns New Inflation Shocks Could Hit ‘At Any Time’

, Bloomberg News

(Bloomberg) -- Global events continue to threaten Switzerland’s price stability despite the country’s strong record on inflation, Swiss National Bank President Thomas Jordan warned.

“In the current environment uncertainty remains elevated, and new shocks can occur at any time,” he said on Friday. “We will therefore monitor the ongoing development of inflation closely and adjust our monetary policy again if necessary.”

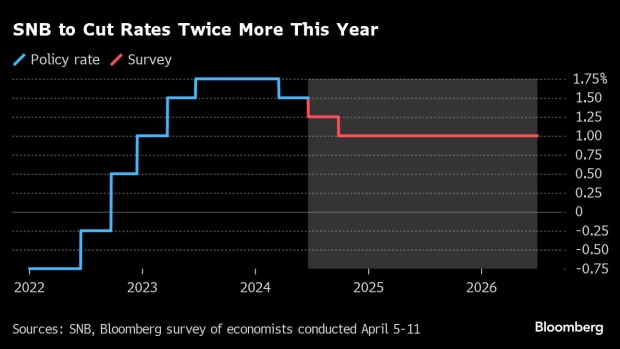

The SNB preempted global peers and started cutting interest rates in March, and two more moves are expected in June and September. Even so, Jordan — speaking at the at the central bank’s annual shareholder meeting in Bern — cautioned that there’s “no guarantee” that the current favorable consumer-price outlook will hold.

Jordan himself may avoid having to deal with such challenges, as he will exit the SNB at the end of September after more than 12 years at its helm. If past practice is any indicator, Vice President Martin Schlegel is the most likely successor.

The prospect of a changing of the guard at the top of the SNB has prompted some critics to call for a broader revamp of the way the institution is run.

However, according to the head of its supervisory Bank Council, the institution is well positioned to fulfill its mandate in the future and doesn’t need reforms.

Speaking alongside Jordan at the shareholder meeting, Barbara Janom Steiner dismissed a number of criticisms raised against the SNB, including lack of diversity, disregarding climate concerns and a too small rate-setting board.

“Demands that restrict a central bank’s independence or weaken its institutional framework by diluting its mandate or making ill-considered changes to its organizational structure jeopardize price stability and, ultimately, social cohesion in our country,” she said.

Climate Protests

She spoke at an event that has often attracted public protest. Climate activists, who criticize the SNB’s investment in stocks of polluting companies, were on the ground again this year. In front of the venue they erected two mock oil drilling towers and held up a poster saying “No financial stability without a stable climate.”

A number of protesters also bought central-bank shares to be able to address the meeting directly. They called on attendees to deny the SNB’s supervisors a formal discharge as they had failed to serve the interests of the Swiss population by not ditching the criticized investments.

The campaigners also tried to have supporters from Argentina describe how oil companies in the SNB’s equity portfolio are threatening their health. The central bank didn’t allow them to enter the venue saying that they weren’t shareholders, according to Janom Steiner.

Jordan — while stipulating that he valued the criticism — dismissed the activists’ demands in a closing statement, saying that climate action doesn’t belong to the SNB’s democratically legitimized tasks.

“You shouldn’t think that with monetary policy you can solve all problems of the world,” he said.

Responding to a separate question, Jordan also added that he sees good reasons to avoid Bitcoin investments. Crypto advocates had previously announced the launch of a campaign to make the SNB hold a part of its reserves in Bitcoin.

Janom Steiner also reinforced the SNB stance that its equity capital must be prioritized over making payouts to the government. The central bank has canceled these annual transfers for two years in a row due to losses.

While the institution reported a 58.8 billion-franc profit ($64 billion) for the first quarter on Thursday, the 2022 full-year loss was so severe that it’s still unclear if a payout will be possible for the current year.

That’s because the SNB’s large foreign-exchange assets amplify gains as well as shortfalls. Franc strength over the full year could still wipe out the quarterly profit.

The SNB is a publicly listed company, though shareholders’ rights are restricted and they can’t influence monetary policy. About 55% of its shares are held by Swiss cantons and cantonal banks, the remaining ones are publicly traded. Switzerland’s federal government doesn’t own any shares.

(Updates with new developments starting in 10th paragraph)

©2024 Bloomberg L.P.