Jan 15, 2021

Strategists see growing bets on emerging-markets via ETF options

, Bloomberg News

Larry Berman takes your questions

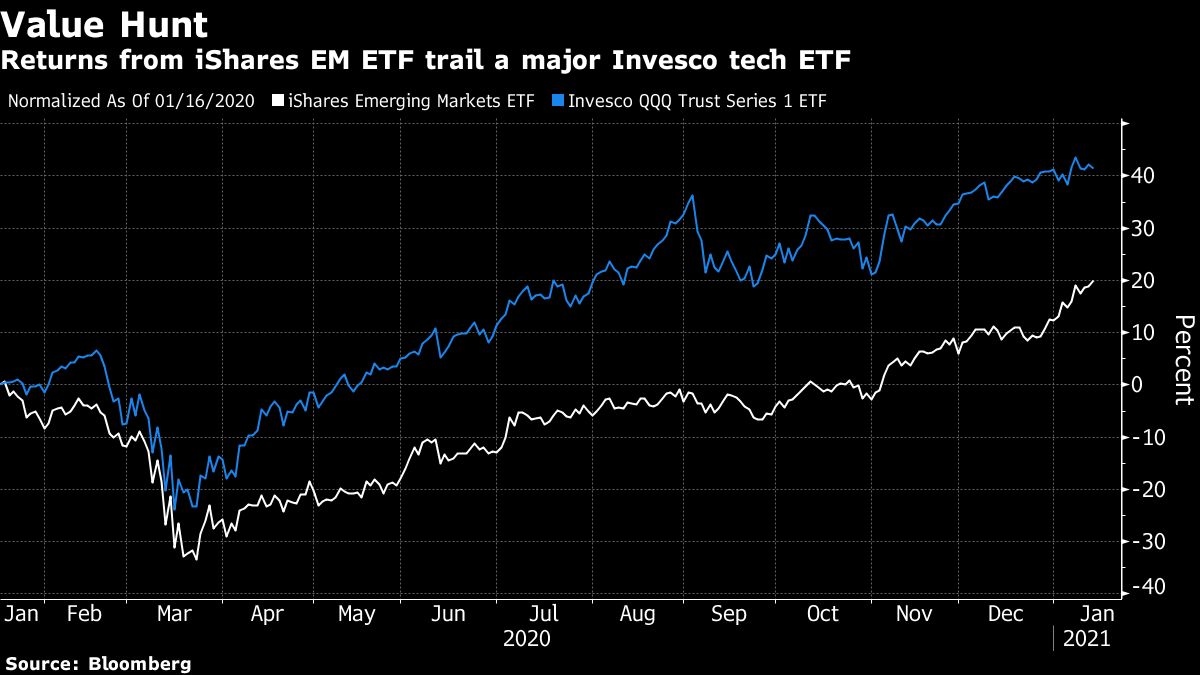

Strategists have detected a growing appetite for bets on emerging markets using options on exchange-traded funds, as investors hunt for assets expected to benefit from a global economic recovery.

Bullish bets are evident on the iShares MSCI Emerging Markets ETF, according to Susquehanna Financial Group LLLP and Nomura Holdings Inc. Optimism is also apparent for China, Brazil and Mexico ETFs, Susquehanna’s derivatives strategist Chris Murphy wrote in a note.

The focus seems to be shifting away from more expensive technology shares to “long-term underperformers,” Murphy said.

Investors are once again buying call options at a sometimes feverish pace, one sign of potential froth in markets awash with stimulus. Meanwhile, the MSCI gauge of emerging-market shares is near all-time highs amid optimism over a global economic rebound.

The exuberance in the options market is now seeping over to cyclical value ETFs, Nomura’s Charlie McElligott wrote in a note.

The iShares MSCI Emerging Markets ETF is “on the cusp of a long term breakout,” Michael Purves, chief executive of Tallbacken Capital Advisors LLC, said Wednesday. He recommended certain call options on the fund, or taking larger positions in either the ETF or emerging-market stocks for those who don’t use options.