Oct 14, 2021

'Strong conviction': Top strategist pounds the table on Buy Canada

By Noah Zivitz

Energy will be resilient for the coming months, loonie to follow: Economist

The chief strategist of National Bank of Canada says the S&P/TSX Composite Index is the place to be for investors - particularly those who want a hedge against inflation. And he's warning pension funds that have turned their back on Canada may come to regret the decision.

"The global economy, notwithstanding some uncertainty relating to the global supply chain, is just chugging along and ... you know inventories are so depleted that there's going to be high demand for global industrial production for the foreseeable future. You would expect the Canadian economy and the Canadian stock market to do well in this environment," said Stéfane Marion, who also serves as National Bank's chief economist, in an interview Thursday.

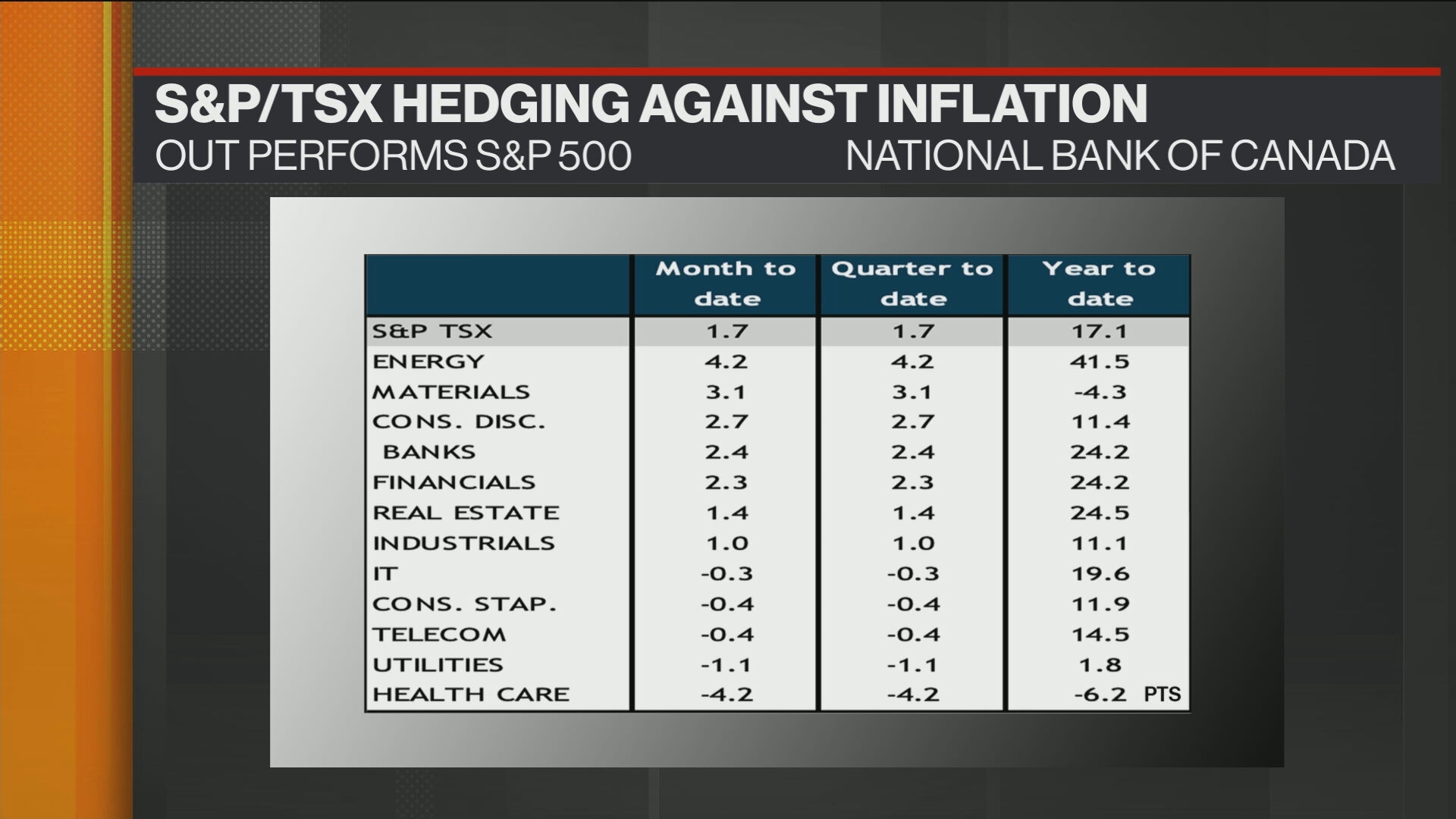

Marion and his team presented historical data to clients Thursday to illustrate their view that Canada offers attractive baked-in hedges against inflation. According to National Bank, the TSX delivered an average annualized return of 2.3 per cent in periods when inflation topped four per cent for prolonged periods. By comparison, the S&P 500 posted a negative return of 5.9 per cent during those same periods.

In the interview, Marion acknowledged that Canada's equity market -- and the energy sector in particular -- has fallen out of favour in some circles as pressure mounts on major global institutional investors to take ESG (environmental, social, governance) factors into consideration. As far as he is concerned, however, Canada's energy sector isn't getting the credit it deserves.

"I understand that ESG concerns are paramount now for investment decisions," he said. "But at the same time, it is false to say that the Canadian energy sector isn't doing anything."

And while there have been some high-profile examples of top international investors turning their back on Canadian energy stocks, most notably when Norway's trillion-dollar sovereign wealth fund blacklisted names like Suncor Energy Inc. and Canadian Natural Resources Ltd. last year, it has recently also become a domestic phenomenon.

Last month, as part of its broader climate strategy, the Caisse de dépôt et placement du Québec said it will exit its exposure to oil production by the end of next year.

"To the extent that [Canadian energy is] transitioning, I don't think that we should discourage them to transition," Marion said, while pointing to Europe's energy crisis as a case study in "disastrous scenarios" that the world faces if economies abandon fossil fuel in haste.

"I think that from an investment perspective, you have a responsibility to protect your downside and at the same time, yes - you can still be ESG and invest in Canadian energy, provided that you pick the right companies. As I say, I insist we have global leaders in terms of carbon capture and so not all energy is bad in this type of framework."

Canada's energy stocks have become the star performers on Bay Street this year, with the TSX's energy subgroup surging almost 46 per cent year-to-date through the end of trading Thursday, when once again the group contributed to gains on a day when the index came within two points of closing at a record.

And as far as Marion is concerned, there are more gains to come.

"We have uncertainty relating to monetary policy going forward so that could rock the markets; but on a relative basis, I absolutely have strong conviction that Canada is the place to be and that will also mean a stronger Canadian dollar," Marion said, going on to add that according to his team's models, the loonie is undervalued by as much as 10 cents.