Feb 4, 2021

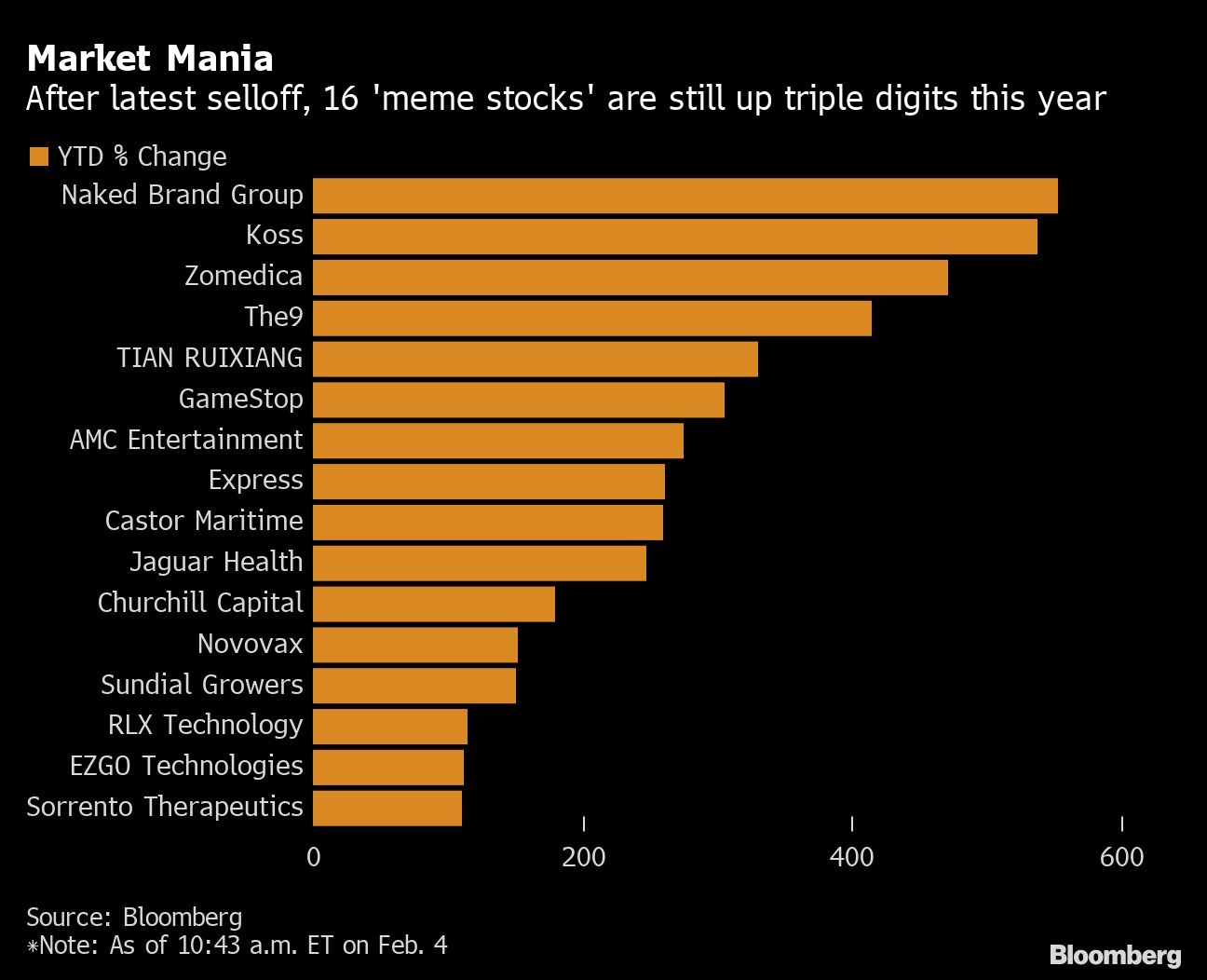

There are still 16 meme stocks with at least 100% gains in 2021

, Bloomberg News

Retail investors will be left holding the bag when the fast money leaves: Citi Private Bank's Bailin

While it may seem that the “meme stock” mania is dissipating following GameStop Corp.’s US$27 billion wipe-out, there are still 16 companies whose shares are up triple digits this year.

Of the 50 stocks that Robinhood originally put on its restricted list, roughly a third have doubled or more in price in 2021, while only six are lower year-to-date. Leading the pack is Naked Brand Group Ltd., whose shares are 546 per cent higher this year. Koss Corp. is up 528 per cent while GameStop shares are still hanging onto a gain of 317 per cent.

It’s a reminder that the wild ride may be far from over for these stocks. While US$164 billion in value has been wiped from those 50 companies in a matter of days, data compiled by Bloomberg show, that came after US$276 billion in market cap was added from the start of the year through the height of the frenzy.

“There’s still a huge appetite for this type of trading,” said Chris O’Keefe, managing director at Logan Capital Management. “There’s still a lot of energy to continue to speculate on the stock market.”

READ MORE: 'No controlling' next stock spike in retail rally: WallStreetBets founder

Over the past 24 hours, AMC Entertainment Holdings Inc., Churchill Capital Corp., GameStop and Sundial Growers Inc. were the four most-frequently mentioned stocks on Stocktwits -- which bills itself as the largest community for investors and traders -- according to data compiled by Bloomberg. All four were among the 50 stocks curbed by Robinhood last week, and all four are up at least 150 per cent in 2021.

It’s likely that any unwind is going to take weeks, rather than days, due to the fact that professional investors have gotten involved too, according to Arthur Hogan, chief market strategist at National Securities Corp. For example, hedge fund Mudrick Capital Management gained almost US$200 million from its stakes in stocks including AMC and GameStop.

“This trend, or the unwind of the crazy short squeeze, likely is going to take a little bit longer than a couple of days,” Hogan said. “The fundamental driver behind that taking longer has to do with the players -- it’s not all a bunch of guys sitting in their mom’s basement.”