Sep 20, 2018

Tilray’s 800% surge has topped these Canadian household names

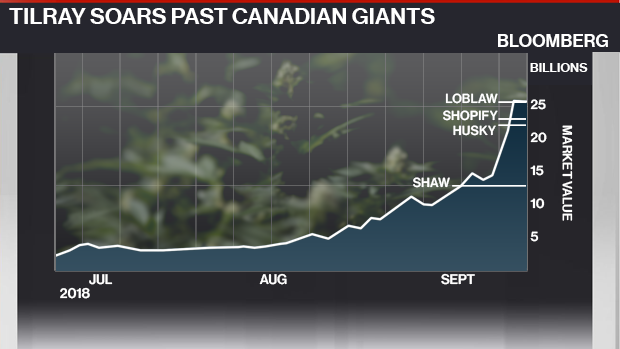

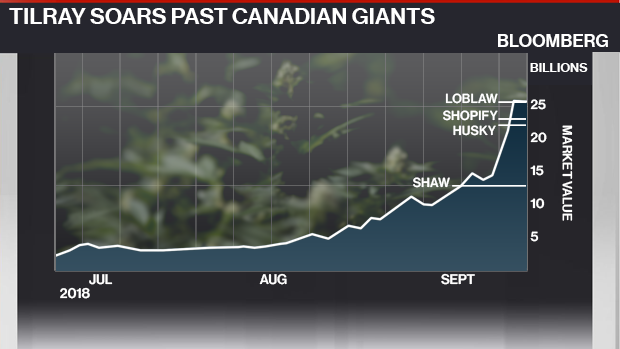

It has barely been two months since Nanaimo, B.C.-based Tilray Inc. went public on the Nasdaq, but already the Canadian marijuana producer has grown in value by more than 800 per cent – all without having ever turned a profit. Such rapid valuation growth has catapulted the cannabis grower past some of Canada’s largest and most recognizable companies.

Below, BNN Bloomberg shows how Tilray compares to some of its newfound peers.

| 2017 REVENUE (C$) | MARKET CAPITALIZATION (C$) | |

|---|---|---|

| Tilray | $25.8 million | $25.75 billion |

| Loblaw | $46.51 billion | $25.55 billion |

| Shopify | $853 million | $22.71 billion |

| Husky | $20.61 billion | $21.93 billion |

| Shaw | $5.15 billion | $12.79B billion |

| LATEST QUARTERLY PROFIT (C$) | MARKET CAPITALIZATION (C$) | |

|---|---|---|

| Tilray | -$16.5 million | $25.75 billion |

| Loblaw | $421 million | $25.55 billion |

| Shopify | $2.5 million | $22.71 billion |

| Husky | $448 million | $21.93 billion |

| Shaw | -$91 million * | $12.79 billion |

*Shaw took a $284 million impairment in its latest quarterly results related to its investment in Corus Entertainment. The company generated $133 million in profit during the same quarter in the previous year.

Cannabis Canada is BNN Bloomberg’s in-depth series exploring the stunning formation of the entirely new – and controversial – Canadian recreational marijuana industry. Read more from the special series here and subscribe to our Cannabis Canada newsletter to have the latest marijuana news delivered directly to your inbox every day.