Jul 6, 2020

Top Performing Philippine Stock Fund Braces for Market Fall

, Bloomberg News

(Bloomberg) -- After the best quarter for Philippine stocks in seven years, the nation’s top-performing fund manager is holding onto cash in anticipation of a pullback.

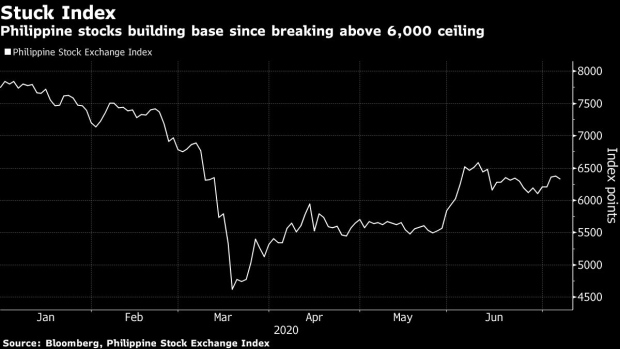

Dennis Elayda, chief investment officer at Philippine National Bank, estimates the nation’s benchmark equity gauge could dip to 6,000 in the next three months, or 5% below Monday’s close. His PNB Equity Fund returned almost 26% in the second quarter, beating all of its peers as well as the 17% rally in the Philippine Stock Exchange Index.

The country’s stocks climbed in step with global peers as restrictions began to ease at home and abroad after pandemic lockdowns. Coronavirus cases in the Philippines rose by a record on Sunday, however, sparking fresh concerns over the impact on an economy already set for its deepest slump in three decades.

“The rally may not be sustained because of the possibility of a second wave, and earnings for the second quarter will be a lot lower than the decline we have seen in the first quarter,” said Elayda, who manages a total of about 100 billion pesos ($2 billion).

Elayda recommends selling if the index reaches 6,400, about 1% above the current level. He remains underweight on stocks, while maintaining cash levels of 5% to 12% of assets depending on market levels and volatility. The strategy stands in contrast to that of U.S. fund managers, who have slashed cash positions to chase the recent rally in equities. It could prove valid if Philippine shares stick to their usual pattern of declining in the third quarter.

The fund manager is sticking with “consumer essential” and “defensive” stocks, betting these sectors will better withstand any near-term market dip. His top picks include grocers Puregold Price Club Inc. and Robinsons Retail Holdings Inc., tuna canner Century Pacific Food Inc., power retailer Manila Electric Co., and telecommunications carriers PLDT Inc. and Globe Telecom Inc. Banks may report good second quarter earnings due to trading gains, but rising loan defaults are a risk, Elayda said.

The Philippine stock index could climb to as high as 6,700 by year-end due to monetary and fiscal policies aimed at mitigating the pandemic’s damage and prospects of a fourth-quarter recovery as construction and government infrastructure pick up, the PNB money manager said.

While Elayda will look to “reposition” on near-term pullbacks, he remains cautious with the benchmark trading at around 16 times estimated earnings for the next year, back near its five-year average.

“It’s a lot more difficult now compared to March because the market has sharply gone up and many names have rebounded from their lows,” he said. “It’s now down to choosing which ones offer the most value amid the possibility of a second wave and while we still don’t have a vaccine.”

©2020 Bloomberg L.P.