Housing starts down seven per cent in March from February: CMHC

Canada Mortgage and Housing Corp. says the annual pace of housing starts in March declined seven per cent compared with February.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Canada Mortgage and Housing Corp. says the annual pace of housing starts in March declined seven per cent compared with February.

A rebound at John Paulson’s family office boosted returns last year but it still wasn’t enough to keep the billionaire investor from having to play catch-up.

New home construction in the US slowed last month as a leveling off in interest rates has given way to a lull in housing demand and caution among builders.

Citadel founder Ken Griffin’s efforts to build a 62-story office tower on Manhattan’s Park Avenue have taken a significant step forward.

As the US economy hums along month after month, minting hundreds of thousands of new jobs and confounding experts who had warned of an imminent downturn, some on Wall Street are starting to entertain a fringe economic theory.

May 10, 2021

, BNN Bloomberg

The shift in the nature of work and consumer shopping habits brought on by the COVID-19 pandemic is on full display in the downtown Toronto commercial real estate space.

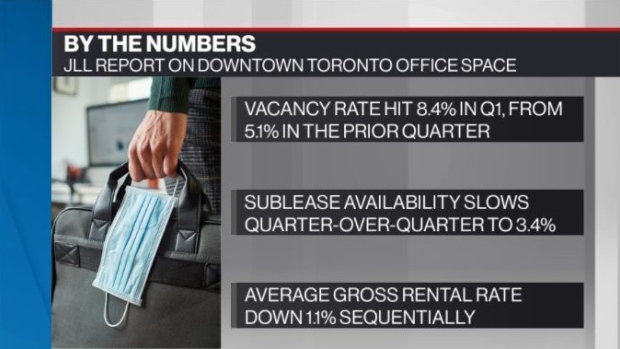

New reports by commercial real estate services firm JLL said the office vacancy rate in the downtown core rose to 8.4 per cent in the first quarter – up from 5.1 per cent in the prior quarter – as the 1.52-million square foot CIBC Square office tower came online.

Many businesses have taken a close look at their office needs during the pandemic as large swaths of employees began working from home: now they need to envision what the future of their workplace looks like and prepare for the return of some or all of their workers to the office.

Among the highest-profile businesses to publicly reassess that need is Shopify Inc.

Shopify Chief Executive Officer Tobi Lütke has declared the firm is now “digital by default” and that the firm will continue with a work-from-home centric model even after the pandemic passes.

With vaccination rates rising both in Ontario and the rest of the country and businesses looking to have workers return to the office, JLL points out that growth in the number of businesses subleasing their empty office space is beginning to slow.

“This falling rate of increase is significant, as it suggests that we could be at or near a peak in subleasing. Tenants are beginning to plan for a post-COVID workplace, and many are realizing that even with a more flexible occupancy model, it is not in their interests to shed as much [office space] as they anticipated,” the report said.

While companies that need to utilize offices have had no trouble finding space for rent, the opposite can be said for industrial-based businesses, which have been key in feeding the surge in demand for goods as Canadians endured more than a year of working, and shopping, from home.

“The Toronto industrial market has continued to run at full speed to kick off 2021,” JLL said.

Industrial vacancy rates have remained below the two per cent mark for ten straight quarters.

With space at a premium, buildings that are currently under construction but can be ready for immediate occupancy are being snapped up at lightning speed.

“Almost 74 per cent of under construction space has now been taken by a user which is up from

55.4 per cent in Q2 2020,” the report said.

As more consumers shop online, businesses are increasingly needing warehouse storage and fulfillment space for their products.

JLL believes industrial vacancy rates will remain at these low levels and could even worsen this year.

“This will keep upward pressure on rental rates and is expected to ignite significant speculative construction starts later this spring and summer,” the report said.