Jun 22, 2021

U.K. Retail Property Is ‘Turning the Corner,’ JPMorgan Says

, Bloomberg News

(Bloomberg) -- Retail property in the U.K. “is turning the corner” following years of decline for the sector, according to analysts at JPMorgan Chase & Co.

A series of “encouraging trends” are emerging in terms of the number of people who are planning to visit malls and retail parks after the pandemic and in consumer behavior on e-commerce and mall apps, analysts Neil Green and Tim Leckie wrote in a note to clients.

Malls have been put under huge pressure in recent years by a structural shift as people shop online rather than go to physical stores. The pandemic has accelerated this trend and exacerbated the sector’s problems as locked down consumers have been unable to visit outlets.

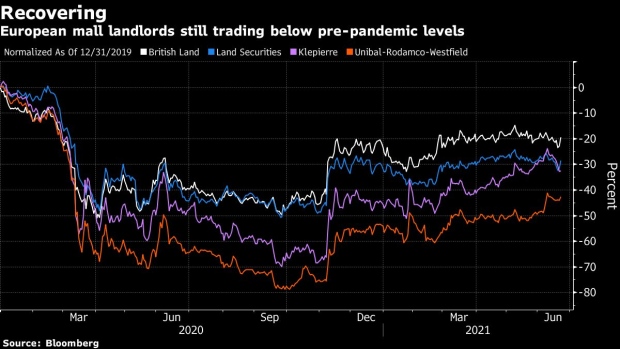

Retail property owners like Klepierre SA and Unibail-Rodamco-Westfield, along with retail and office landlords British Land Co. and Land Securities Group Plc have recovered ground since the pandemic-induced plunge in their share prices in March 2020. All, however, are still trading below pre-pandemic levels.

Green and Leckie upgraded the broker’s rating on British Land to overweight, driven by the encouraging trends in retail property, and also raised Land Securities to overweight after recent underperformance. They cut Klepierre to underweight, however, as the reopening trade which has helped its stock to recover “runs out of fuel.”

©2021 Bloomberg L.P.