May 28, 2021

U.S. Corporate Bond Spreads Hit 14-Year Low as Economy Resurges

, Bloomberg News

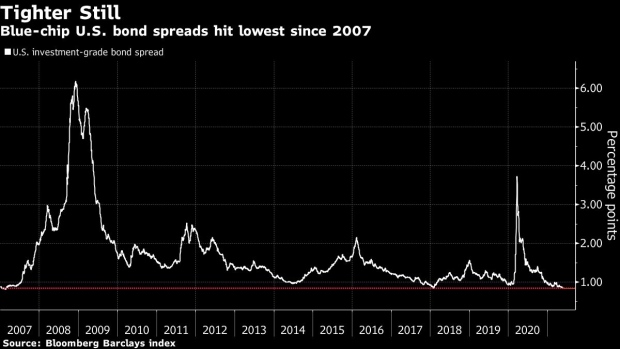

(Bloomberg) -- U.S. high-grade bond spreads fell to a 14-year low Friday as investors temper their inflation projections and grow bullish on a reopening economy.

The risk premium on investment-grade debt tightened one basis point to close at 84 basis points over Treasuries, a level last seen in 2007, according to Bloomberg Barclays index data. An accelerating U.S. economic recovery has boosted corporate earnings this year, putting high-grade bonds on track to post positive returns for the second consecutive month following their worst start to the year since 1980.

Cheap borrowing costs have encouraged issuance to stay steady, with sales this month of $136 billion broadly in line with estimates and borrowers able to bring new deals with minimal concessions to their outstanding debt.

Still, some say the rally has gone too far and there’s nowhere to go but down. Retail flows may be starting to paint a similar picture -- high-grade bond funds took in just $911 million of cash in the week ended May 26, the least this year.

The outlook for inflation is also adding to uncertainty, and investors could get skittish in the event Treasury yields resume an upward climb. New federal tax policies that target corporate earnings also have the potential to disrupt the strong performance of late.

©2021 Bloomberg L.P.