Dec 15, 2021

U.S. retail sales trail forecast, suggesting drag from inflation

, Bloomberg News

Consumer purchase intentions for big ticket items have all collapsed, that's pretty concerning: Strategist

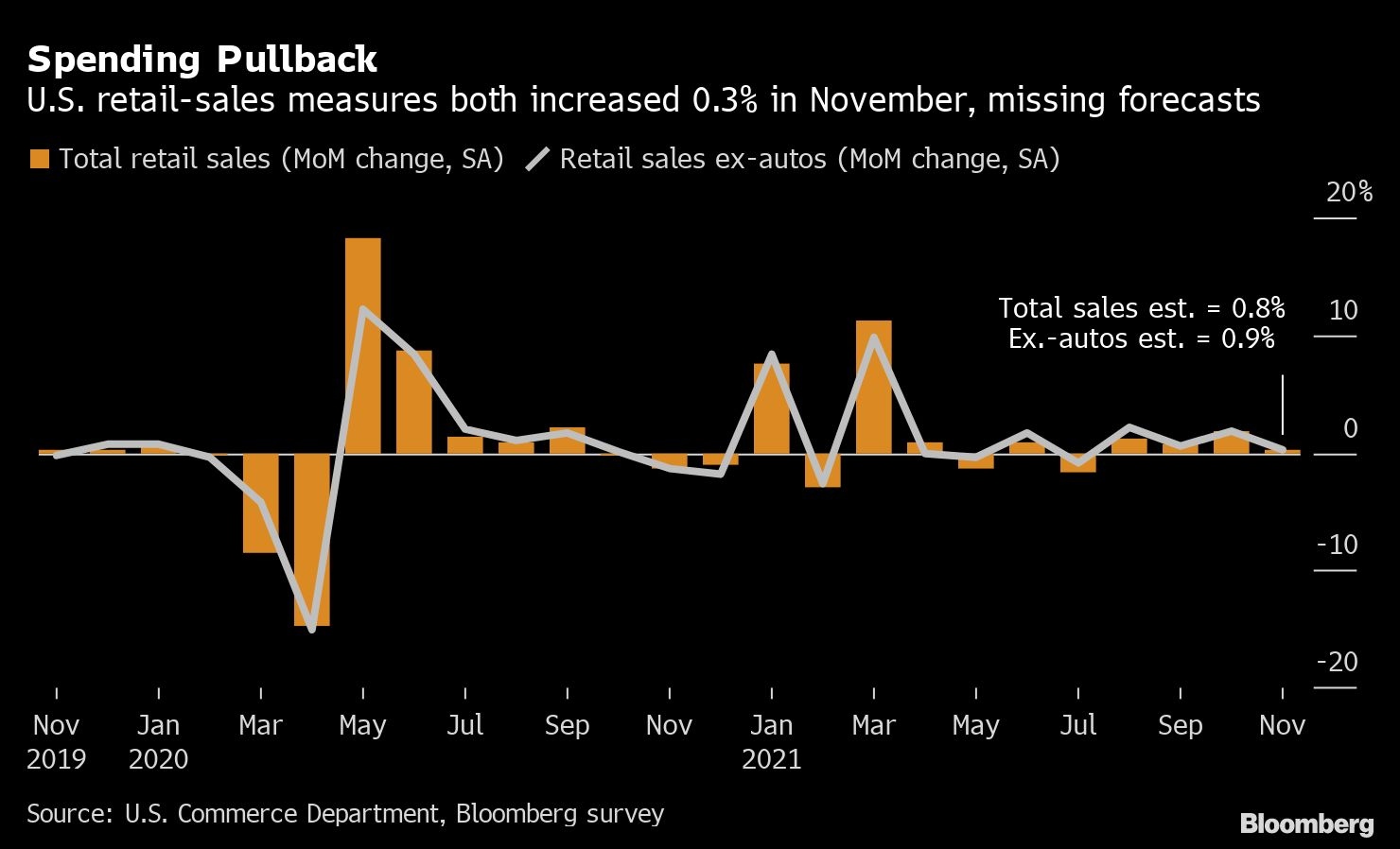

U.S. retail sales rose by less than forecast in November, suggesting that consumers are tempering purchases against a backdrop of the fastest inflation in decades.

The value of overall retail purchases increased 0.3 per cent, the smallest advance in four months after a revised 1.8 per cent gain in October, Commerce Department figures showed Wednesday. Excluding gas and motor vehicles, sales climbed 0.2 per cent in November. The figures aren’t adjusted for inflation.

The median estimate in a Bloomberg survey called for a 0.8 per cent gain in overall retail sales from the prior month. The S&P 500 was little changed and the yield on the 10-year Treasury note ticked higher ahead of the conclusion of the Federal Reserve’s two-day meeting.

The softer-than-expected report may also reflect the pulling forward of holiday sales as many Americans, aware of supply-chain slowdowns, shopped earlier than usual. In October, the sales increase was the strongest in seven months.

“Crowding more holiday shopping earlier in the fall does not change our estimate for stellar consumer performance in the final quarter of the year, barring a harsher-than-expected impact from omicron and higher inflation,” Bloomberg Economics’ Yelena Shulyatyeva and Eliza Winger said in a note.

U.S. consumer prices are rising at the fastest rate in almost 40 years. Accelerating inflation risks may give consumers additional pause in coming months, especially as remaining fiscal supports like a moratorium on federal student loan payments end early next year.

The figures surface ahead of a decision later Wednesday by Federal Reserve policy makers as to whether they should accelerate the pullback of monetary stimulus in the face of faster inflation.

Inflation-adjusted consumer spending data for November that includes services will be released next week.

SALES BREAKDOWN

Five of the 13 retail categories showed declines in receipts last month, led by a drop at electronics and appliances merchants. Sales at non-store retailers, which includes e-commerce, were little changed in November.

Rising prices could be driving some of the increases in categories like gasoline stations and grocery stores. Receipts at restaurants and bars, the lone services-oriented category in the data, climbed 1 per cent.

So-called control group sales -- which are used to calculate gross domestic product and exclude food services, auto dealers, building materials stores and gasoline stations -- fell 0.1 per cent in November from a month earlier.