Jun 18, 2021

Unicorn Rainmaker Amasses $1 Billion for Latin America Startups

, Bloomberg News

(Bloomberg) -- As lockdowns started to sweep across the globe last year, venture capitalist Hernan Kazah sent an ominous message to his portfolio of Latin America tech startups: cut costs and preserve cash in what Kazah thought would be an all-out effort to survive the pandemic.

Now just over a year later, Kazah is less concerned about the survival of the region’s burgeoning tech scene than he is with how to spend the $1 billion of cash his firm just raised. Because rather than decimate startups, the lockdowns boosted sales for tech companies as customers tapped into their phones to do everything from order food to bank online as the spread of Covid-19 kept people at home while taking its tragic toll.

Kaszek Ventures, the venture capital company Kazah and partner Nicolas Szekasy founded a decade ago after leaving e-commerce giant Mercado Libre, have already invested in a roster of so-called unicorns, startups worth $1 billion or more.

As the pandemic unfolded, they saw so many investment opportunities arise that they moved up plans by months to raise new funds that will be used for investments in startups in coming years, Kazah said in an interview this month. The result was the biggest venture capital round in Latin America’s history, in another sign the region has catapulted from an innovation backwater to an emerging region for the world’s tech investors.

“The start of the pandemic was horrible. Companies had to recalibrate and adjust. But then a month and a half in, we saw the opposite: demand kept increasing and increasing,” Kazah said. “It accelerated so much and there were so many really great investment ideas that we really didn’t want to be left without dry powder.””

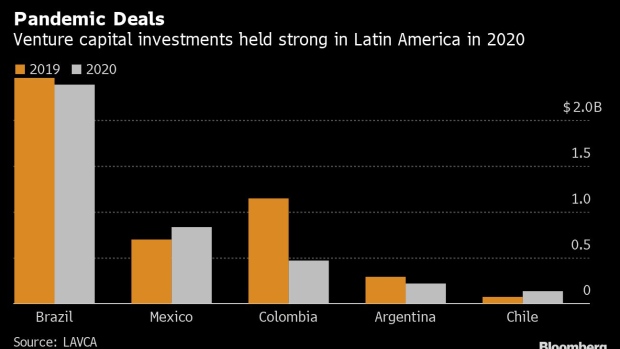

While Latin America has been one of the hardest-hit regions in the world by the pandemic, that has hardly made a dent in the pace of venture activity. Last year, investors rang up a record number of deals while pouring more than $4 billion into startups for a second-consecutive year, according to the Association for Private Capital Investment in the region. The association, known as LAVCA, estimates first quarter investments were north of $2 billion.

Unicorns

Kaszek raised $475 million it plans to spend on early-stage startups and $525 million for a fund that will be largely dedicated to companies in which it has already made an investment. The funds were several times oversubscribed, with demand coming from across the world, including strong interest from Asian institutions as well as investors in Latin America, Kazah said.

Wesleyan University and California-based Sequoia Heritage are listed among its investors. Other backers were not disclosed.

The demand may be partially explained by the firm’s track record of picking winners, with at least nine unicorns in its portfolio. Among them, Kaszek counts investments in Brazilian fintech Nubank, which is valued at $30 billion after receiving an investment from Berkshire Hathaway, Mexican used car platform Kavak and real estate firm Quinto Andar.

With its new funds, Kaszek will target companies in which technology plays a fundamental role, Kazah said. He expects financial technology, or fintech, to continue to grow, as well as e-commerce and education companies. The firm looks at companies across Latin America, but will be focused on Brazil, Mexico and Colombia, he said.

After seeing a banner period for initial public offerings on the Brazilian stock market, Kazah expects “many companies” from Kaszek’s portfolio to go public in coming years.

With every portfolio it builds, the firm sees a “big group of companies” that it sells at costs or loses its investment, he said.

“At the end of the day if you build a portfolio just with successes, that means you’re not taking enough risks,” he said. “Whenever we build a portfolio of 20 or 30 companies, we have maybe, if we’re lucky, a handful of big winners.”

©2021 Bloomberg L.P.