May 20, 2020

Wall of Provisions Casts Shadows Over Europe’s Best Economy

, Bloomberg News

(Bloomberg) -- Polish banks escaped the brunt of the Great Recession in 2008. This time around, a wave of heavy provisioning suggests that they’re worried they may not be so lucky.

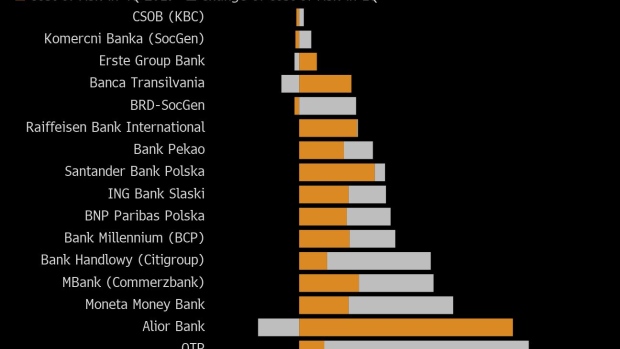

With the coronavirus crisis threatening to wreak worse havoc on global economies, Poland’s financial institutions are leading east European banks in front-loading potential losses. The concern is that forecasts for the country may be too optimistic and safeguards against the spread of Covid-19 will devastate their balance sheets.

Polish lenders increased write-offs for credit risk by 53% in the first quarter, which cut the national industry’s total net income in half. The largest central European nation braces for its first recession since 1991 and a wave of interest-rate cuts to record lows, a plunge in consumer spending and loan-repayment holidays raise the risk bank profits will be wiped out before any recovery.

“There is no standard about coronavirus write-offs, but we know that if we have this unprecedented situation and we don’t know the future, we want to behave conservatively,” said Slawomir Sikora, the chief executive officer of Citigroup’s Polish unit, Bank Handlowy SA, in a conference call on May 14. His bank reported one of the biggest increases in the cost of risk among Polish lenders.

Central and eastern European governments have been among the most successful in avoiding the ravages of the pandemic, with some of the world’s toughest lockdowns and strictest social distancing measures, as shown by shallower economic contractions than in the West. Even so, banks from the Baltics to the Balkans are scrambling for ways to further soften the blow, supported by monetary stimulus from central banks.

Poland’s economy, the only one in Europe to not fall into recession after the global economic crisis 12 years ago, is expected to shrink 3.5% this year. That’s still the rosiest prognosis on the continent, even as the second quarter will likely show devastating losses in all industries, with a knock-off effect on financial institutions.

While many Austrian, Romanian and Czech lenders haven’t significantly increased impairments before they have more clarity about what’s ahead, most Polish lenders already doubled loan write-offs in the first quarter, before their portfolios showed any deterioration. Making use of IFRS 9 accounting standards, they took a forward-looking approach to assess how their clients may be hit by the two-month-old crisis, with the retail and leisure industries seen at the highest risk.

Polish banks began availing themselves of the relatively new standard for impairments last year, after Swiss-franc mortgage borrowers got support for their legal battles by the European Union’s top court. As a result, most lenders started to write off not only loans from clients initiating the lawsuits, but expanded provisioning to all non-zloty mortgages.

Though Polish banks as a group lead in provisioning, Hungary’s top lender, OTP Bank Nyrt. front loaded the most in the first quarter. The bank may be the most at risk because its operations stretch from Slovenia to Russia. For some analysts, including MBank broker’s Michal Konarski, the region’s overall provisioning levels may be too low as they amount to only half of what was set aside during the 2008-2009 crisis.

Quantitative Easing

As the second-quarter lockdown continues to depress business, central banks in the region have deployed bond-buying programs to boost lenders’ liquidity and facilitate the funding of government stimulus plans. Lenders also have high capital and liquidity ratios, which may help them ride out the worst of the virus restrictions.

Still, they are only now adjusting to record-low interest rates and analysts are studying new data as industries begin to ease restrictions, reboot and harness government aid programs into business plans. Polish lenders are helping to distribute state subsidies in a bid to accelerate delivery of resources and keep clients solvent as long as possible.

“Banks will need even some months after the end of loan repayment holidays to get a better understanding of the potential loan defaults,” Kamil Stolarski, an analyst at Santander Bank Polska SA’s brokerage, said in an email. “For now, we are all groping in the dark.”

©2020 Bloomberg L.P.