Apr 19, 2024

Panama Pledges to Meet Fiscal Goal as Mine Closure Halves Growth

, Bloomberg News

(Bloomberg) -- Panamanian officials are meeting rating firms this week to reinforce their commitment to fiscal and growth targets amid rising investor concern about the country losing its investment-grade status.

“We are on a downward path — in a progressive way — in the fiscal consolidation, and on an upward path in the growing of the economy,” Deputy Finance Minister Jorge Almengor said Thursday in an interview on the sidelines of the International Monetary Fund and World Bank meetings in Washington. “We hope that they understand.”

Panama’s fiscal deficit will drop to 2% of gross domestic product this year, down from slightly below 3% last year, while growth should total 2.5%, in line with the IMF forecast, according to Almengor. Without the shutdown of the $10 billion Cobre Panama mine, the economy would have expanded 5%, still down from more than 7% last year, he added.

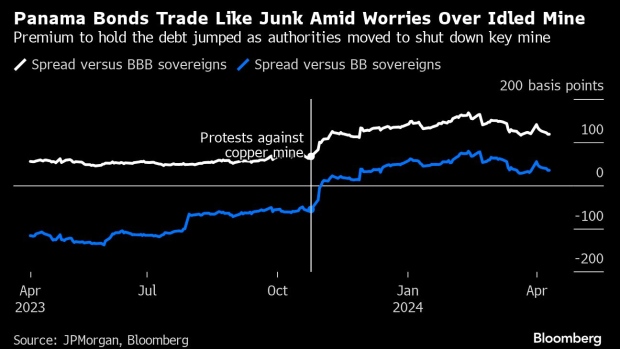

Worries about the idled mine took a toll on the bonds, and already have traders treating the nation’s debt like a junk-rated credit: investors now demand more than 30 extra basis points to hold Panama notes compared to the average risk premium for BB-rated sovereign securities, according to JPMorgan Chase & Co. figures.

On Thursday, notes maturing in 2036 were down 1.3 cents on the dollar to 94.3 cents, the lowest since late February and trailing emerging-market peers. Investors were left concerned about the country’s fiscal prospects and growth outlook after a meeting with the IMF mission chief in Washington on Wednesday, according to two people with knowledge of the matter, who asked not to be named because discussions were private.

The meeting, which was attended by about 15 investors and analysts, also raised doubts about the mandate for incoming government, one person added. The IMF didn’t respond to a request for comment on the gathering.

With the presidential election scheduled for May 5, investors still await clues on what the new administration will do to address investor concerns. Jose Raul Mulino, an ally of ex-president Ricardo Martinelli and a pro-business name — is in the lead, followed by former president Martin Torrijos and attorneys Romulo Roux and Ricardo Lombana, according to the latest opinion polls.

Read More: A $10 Billion Closed Mine Casts Shadow Over Panama Vote, Bonds

Fitch Ratings — the first credit assessor to cut Panama to junk — said that a “tense” social backdrop should limit the room for the next president to implement much-needed reforms. Moody’s Ratings and S&P Global Ratings could follow as soon as in the second half of the year, some analysts say.

“We are very focused on the overall transition program for the next administration,” Almengor said. “We are compiling a series of relevant projects and strategies that the upcoming administration will need to consider in order to continue the prosperity of the country.”

Almengor is the deputy for Finance Minister Hector Alexander, a University of Chicago-trained economist that was taught by Milton Friedman.

--With assistance from Maria Elena Vizcaino, Zijia Song and Ramsey Al-Rikabi.

©2024 Bloomberg L.P.