Aug 16, 2022

Inflation: These are the grocery items that grew in cost

, BNN Bloomberg

Recession in Canada is unavoidable: David Rosenberg

Canadians’ grocery bills continued to climb as the price of food increased by 9.9 per cent year-over-year in July, according to Statistics Canada.

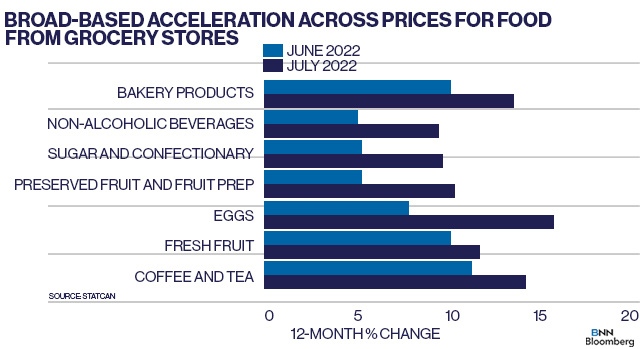

The cost of eggs rose the most by 15.8 per cent, while coffee and tea came in second with a 13.8 per cent increase.

Statistics Canada said bakery products climbed at a faster pace of 13.6 per cent year-over-year, as higher input costs and supply uncertainty related to Russia’s attack on Ukraine pushed wheat prices higher.

Here are the other food-related price changes for July:

- Non-alcoholic beverages climbed 9.5 per cent

- Sugar and confectionery gained 9.7 per cent

- Preserved fruit and fruit preparations rose 10.4 per cent

- Fresh fruit jumped 11.7 per cent

GROCERY STORE DISCOUNTS?

Despite ongoing increases in food costs, Sylvain Charlebois, senior director at the Agri-Food Analytics Lab with Dalhousie University, said these numbers are reassuring as food-related inflation is continuing to fall from its May peak.

He added that lower overall volatility in the Canadian economy could result in grocery stores implementing more discount promotions.

“Less volatility will allow grocers to better plan for some more aggressive discounting,” Charlebois said over email Tuesday.

“We are expecting more promotions and loss leading, things we have not seen much of since March 2020.”

Charlebois said he expects areas like dairy and bakery goods to “remain problematic for consumers with a limited budget” and “drive food inflation for a while.”

NAVIGATING HIGHER FOOD COSTS

Melissa Leong, personal finance expert and author of ‘Happy Go Money’ said these additional costs are really going to weigh on Canadians who are already struggling with higher inflation.

“Canadians are already stretched so thin, with many reporting that they’re living paycheque to paycheque and already modifying their spending; they’re going to really feel any uptick in costs,” Leong said over email.

She added that Canadians should “look for any items that you can cut, even temporarily such as subscriptions,” in order to relocate that cash towards immediate needs like bills and debt repayment.

“Be extra intentional about your spending and have a strategy for groceries and meal planning,” Leong said.

“Make use of gift cards, loyalty points, coupons, price matches; check to see if you have any uncashed cheques owed to you from the Canada Revenue Agency or if there’s money owed to you by checking the unclaimed bank balance registry.”

INFLATION EASES WITH GAS PRICE DROP

Statistics Canada reported the consumer price index rose 7.6 per cent on a year-over-year basis in July, which was in-line with economists’ estimates.

The inflation eased from its 8.1 per cent gain in June, which was the highest year-over-year level since January 1983.