Feb 24, 2020

Larry Berman: Don't change investing targets on 'black swan' events like coronavirus

By Larry Berman

Larry Berman: Sanders' policies bigger risk to markets than coronavirus

I’ve read several research reports in the past weeks about the coronavirus' impact on supply chains and the human toll. We are all making guesses — educated guesses, but guesses nonetheless. We learn a valuable lesson from Nate Silver’s book The Signal and the Noise about prediction of extreme events: no one listens until it’s too late. No one has any perfect insight as to how this all plays out. One thing that is clear is that SARS and MERS are not good benchmarks, but they are logical comparisons. From a market return perspective, SARS hit at the bottom of the tech bubble after valuations had be crushed for several years already. Today, the markets have never been more expensive and for portfolios, that’s where the risks lie.

We’ve read that about 30 per cent of every good sold in the world touches China, Japan, and South Korea at least once. We have not vetted that number, I don’t know how you can, but it’s a very big number. At best, these economies are operating at about 50-per-cent capacity for several more months. Worst case, which we don't really want to think about is that the human toll of coronavirus, or COVID-19, could be devastating. At the moment, AAPL and others are chewing through inventories and that helps, but can’t fix the supply chains if capacity is not there.

From a practical economic perspective, supply chains will get rebuilt when the pandemic is over and it will most likely be a supply side “V” shaped recovery versus the prolonged demand-driven “U” shaped recovery. But how long it lasts is key given how widespread this is becoming. Some supply chains that had already been shifted out of China due to U.S. President Donald Trump’s trade wars are now at risk from COVID-19 and frankly, there are few choices. Odds that we see a global recession will not be offset by Xi Jinping or G20 promises of monetary or fiscal policy if people simply can’t work due to social distancing fixes (quarantines). Monetary policies can’t fix this problem.

The better comparison might be that the COVID-19 outbreak could end up resembling the H1N1 (swine flu) pandemic of 2009-10, but that too was during the end of a bigger market crisis that had nothing to do with the depressed market valuation at the time. Despite initial hopes to contain the H1N1, the CDC calculated that 61 million Americans caught the virus over the course of the proceeding 12 months, resulting in over 12,000 deaths. Globally, an estimated 700 million-to-1.4 billion people contracted the virus. A paper published in the Lancet put the number of fatalities worldwide at 151,700-to-575,400. If one billion people caught COVID-19, 20-30 million people could die. The economic impact could be worse than the 2008-09 financial crisis.

The reason one hears less about H1N1 is that death rates were low, along the lines of the seasonal flu. SARS killed five-to-10 per cent of those who contracted it. Based on very preliminary evidence, it appears that the fatality rate from COVID-19 is significantly higher than for H1N1, though well below that of SARS and MERS (killed about one-third of those who contracted it). COVID-19’s true fatality rate remains uncertain, but two-to-four per cent is a reasonable expectation. In Hubei province, the fatality rate is running at 3.1 per cent.

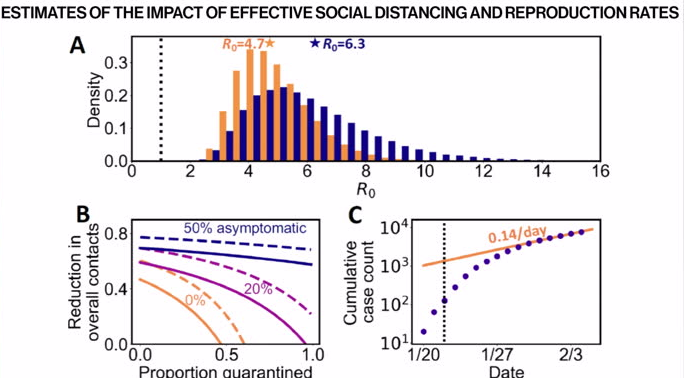

If the value of R0 (R-naught is the reproduction rate) is as high as in other countries, the data show that active and strong population‐wide social distancing efforts, such as closing down transportation system, schools, discouraging travel, etc., might be needed to reduce the overall contacts to contain the spread of the virus.

The high R0 values estimated in a study done by Los Alamos National Labs have important implications for disease control. For example, basic theory predicts that the force of infection has to be reduced to 1 to guarantee extinction of the disease. At R0 of 2.2, this fraction is only 55 per cent, but at R0 6.7, this fraction rises to 85 per cent. To translate this into meaningful predictions, the study uses the framework proposed by Lipsitch et al with the parameters estimated for COVID-19.

Results show that if as low as 20 per cent of infected persons are asymptomatic and can transmit the virus, then even 95 per cent quarantine efficacy will not be able to contain the virus.

If only 20 per cent of people can pass it along when they are asymptomatic, estimates of the impact of effective social distancing (quarantine) might be as high as 95 per cent.

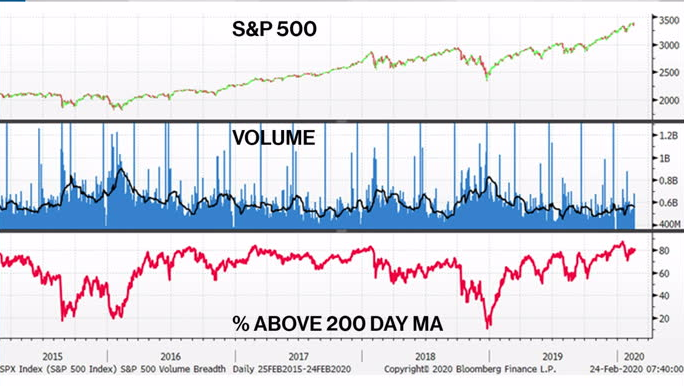

Investors should still never change their long-term portfolio targets or goals based on a true “black swan” event like this. They should not be selling to cash and panicking, but they will and they do. This suggests that you are not in a proper long-term portfolio strategy. What investors should always be doing is considering a part of their portfolio geared to seeking returns that are not highly-correlated to equity markets. Though in times of crisis, almost everything is sold in the peak of panic. We see this by looking at volume patterns in markets around lows compared to highs.

Alternative approaches to investing will likely be an increasingly important part of portfolios moving forward. The goal of alternatives is to get market-based returns that are not the same as generic low-cost market beta. Beta is the market return and the market risk. As a base case, many look at the S&P 500 as “the market” or a beta of 1. This means if you simply bought any of the low-cost ETFs that track the S&P 500, you would have a beta of 1 in your portfolio. You get all the upside and all the downside.

The idea in adding alternatives is to keep the same return as the market and lower your beta risk to something less than one, or keep the beta at one and increase your return relative to the market. Either is a key goal in improving your sleep-at-night factor.

Our upcoming Spring BNN Bloomberg Roadshow will focus on how to include more active based ETFs into your portfolios. From ESG, Defined Outcome, to Alternative (long\short) each more active style has their place. Millennials might like to tilt portfolios towards a more environmentally friendly portfolio, where more risk adverse investors may like defined outcomes, while more adventurous may seek to make money in adverse conditions and might seek out alternatives.

Come out to see how these new and growing areas of ETFs can be included in your portfolios. As always, we ask for a voluntary donation in support of Dementia and Alzheimer’s research at the Baycrest Hospital to attend. We have raised more than $500,000 in the past decade thanks in part to BNN Bloomberg viewers and a matching donation from Larry.

| Halifax | March 18, 2020 |

|---|---|

| Montreal | March 19, 2020 |

| Ottawa | March 21, 2020 |

| Saskatoon | March 24, 2020 |

| Winnipeg | March 25, 2020 |

| Toronto | April 5, 2020 |

| London | April 14, 2020 |

| Waterloo | April 15, 2020 |

| Newmarket | April 19, 2020 |

| Edmonton | April 22, 2020 |

| Calgary | April 25, 2020 |

| Kelowna | May 5, 2020 |

| Victoria | May 6, 2020 |

| Vancouver | May 9, 2020 |

Follow Larry Online

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com