Jan 18, 2021

Larry Berman: Liquidity-driven market about to have less liquidity

By Larry Berman

Larry Berman: Keeping an eye on market liquidity

With major moves in global equities being influenced by central bank liquidity, the markets may now require fiscal policy to extend recent gains. This phenomenon has a name: the equity risk premium (ERP). Basically, it’s the excess return in stocks relative to the risk-free rate. So there’s an imbalance in fundamental supply and demand of the cost of money.

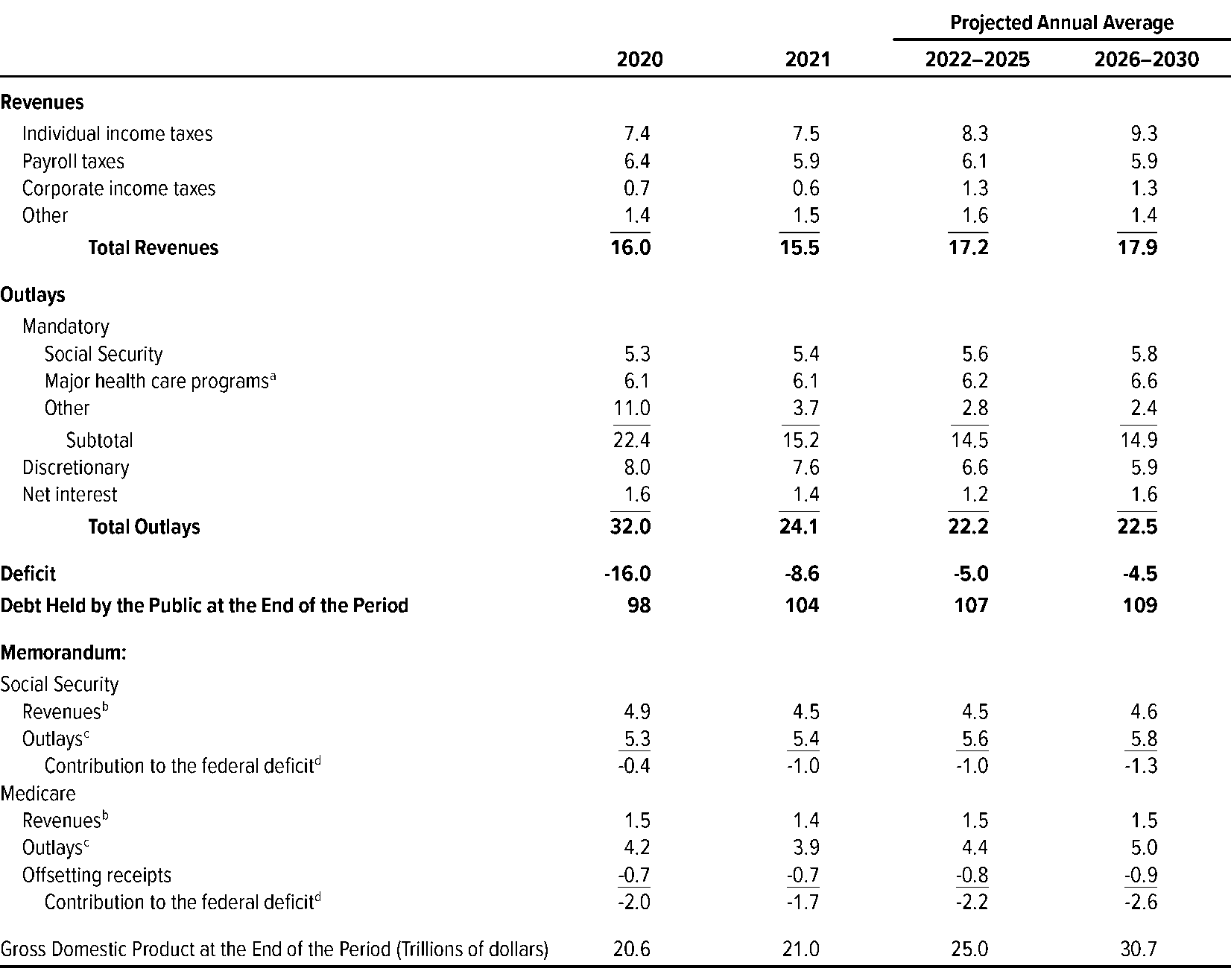

This analysis from the Congressional Budget Office (CBO) was last done in September, well before the latest US$2.8 trillion in additional spending, funding bills and proposals in the U.S. The CBO projected an 8.6-per-cent GDP deficit in 2021 before the new spending. The required funding in 2021 is now in excess of about US$4 trillion, and about US$2.5 trillion more than the U.S. Federal Reserve is currently buying. That money needs to come from somewhere and while taxes will go up, they will not likely be doing so this year.

The market is about to be hit with huge supply problem. But don’t worry, the Fed will step on the gas again. It does not have a choice. It’s only a mater of when and how much. However, expectations of a rising risk-free rate has a direct link to the equity risk premium. It’s one thing when bond yields are rising because the economy is strong, it’s quite another when yields are rising for the wrong reasons.

I found it laughable to hear several central bankers opine last week that it’s time they thought about tapering. If that happens, expect a hit of 20 per cent or more to the S&P 500 (like we saw in late 2018), since the index has been propped up on speculation of endless largesse, a vaccine, and cheap money liquidity.

One of my PRO-II monitors is based on central bank liquidity. It was added to the model in 2020 after completely missing the liquidity that drove market multiples last year. It was unprecedented and colossal.

One of the first financial books I read in 1986 was Martin Zweig’s “Winning on Wall Street.” The fourth chapter was titled “Don’t Fight the Fed.” The quality factor of this economy and market is abysmal. The degree of zombie companies making it because money is cheap is numbing. The number of companies only growing EPS because they are buying back stock is even more outrageous. Last year, I fought the Fed. The hindsight of 2020 confirms that was a bad call. Despite the poor quality of the economy and rally, the ERP drove multiples higher. The deficit math now risks the ERP going the other way.

My basic supply-and-demand analysis of liquidity is that while it’s plentiful from a fiscal standpoint and that - mathematically - that will boost GDP, the multiplier is rich… very rich.

Here comes the supply tsunami and asset markets may not like it. I think that lasts until the Fed steps on the gas again. The first sign that liquidity may be drying up came last week as stocks retreated after the Biden stimulus announcement. The worst performers were many of the growth high-flyers.

This could make for a rough first 100 days for U.S. President-Elect Joe Biden. Fed Chair Jerome Powell said nothing about additional QE last week. The next FOMC is Jan. 27 and then March 17. If Powell does not step up in January, we could see equites have a very rough February.

But a peek into the future based on the CBO forecasts shows the deficits will grow going forward and that the future we are heading to is one of modern monetary theory. I strongly recommend you read Stephanie Kelton’s book Deficit Myth. Not because I agree with the conclusions, but I believe that is what governments will try next to keep the music playing. Social Security and Health Care (entitlement) costs are massive and the printing money is basically the only way to pay for it.

Look for more in the coming weeks from our new Berman’s Call Probable Return on Investment Index, PRO-II Indicator. We will be launching the new website later this month so that BNN viewers can follow along with the various risk and opportunity factors we follow.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com