Centerbridge Partners’ Top Real Estate Dealmaker Rahm to Depart

Centerbridge Partners’ Billy Rahm, who oversees global real estate investing, is leaving the firm, according to people with knowledge of the matter.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Centerbridge Partners’ Billy Rahm, who oversees global real estate investing, is leaving the firm, according to people with knowledge of the matter.

Uniti Group Inc. is in advanced talks to reunite with telecommunications provider Windstream in a merger that could be valued at up to $15 billion, including debt, according to people familiar with the matter. Uniti rose as much as 13%.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Australian Retirement Trust has become the country’s latest pension fund to open a London office, as the fast-growing retirement sector hunts for deals beyond its backyard.

Jan 4, 2018

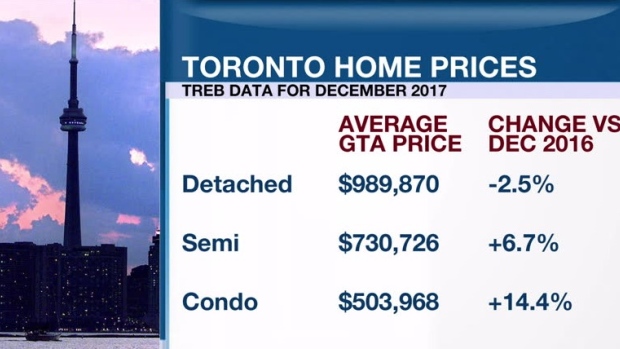

Homeowners in Canada's largest real estate market raced to sell their properties last month ahead of tough new lending rules that took effect at the start of January.

Active listings of homes available for sale surged 172.4 per cent year-over-year across the Greater Toronto Area in December, according to data released by the regional real estate board on Thursday.

Total property sales fell seven per cent year-over-year to 4,930 amid a sharp pullback in the detached property market.

Despite the inventory surge and slowdown in sales activity, the average selling price inched up 0.7 per cent year-over-year to $735,021. Condos led the way with a 14.4 per cent price gain.

Buyers and sellers in Ontario spent much of 2017 navigating major regulatory changes. In April, Kathleen Wynne's Liberal government introduced housing measures, with a 15-per-cent tax on foreign speculators getting most of the attention. Meanwhile, the Office of the Superintendent of Financial Institutions confirmed its B-20 lending guideline in October, which required lenders to stress test new uninsured mortgages as of Jan. 1.

"The Ontario Fair Housing Plan, which included a foreign buyer tax, had a marked psychological impact on the marketplace," said Toronto Real Estate Board President Tim Syrianos in a press release.

"Looking forward, government policy could continue to influence consumer behaviour in 2018, as changes to federal mortgage lending guidelines come into effect.”