Aug 14, 2019

‘50 Cent’ Copycat Likely Made $170 Million Hedging During Rout

, Bloomberg News

(Bloomberg) -- A million-dollar day may have turned into a hundred million-dollar month for the major buyer of U.S. equity volatility as stocks endure one of their worst sell-offs of 2019.

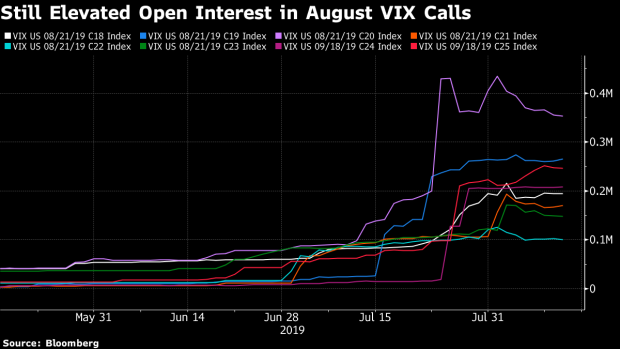

Late July and early August saw massive orders for protection that bore some similarities to transactions by the trader dubbed “50 Cent,” who bought a boatload of derivatives that would benefit from market turmoil throughout 2017 and early 2018. The vehicle, in both cases, were call options on the Cboe Volatility Index, a gauge of the 30-day implied volatility of the S&P 500 Index based on out-of-the-money options.

Maxwell Grinacoff, derivatives and quantitative strategist at Macro Risk Advisors, compiled the theoretical profit and loss statement for this trader based on probable activity. He estimates paper and realized gains on these positions total nearly $170 million.

However, the millions in premium spent on these options suggests the position is intended to be a hedge rather than a directional bet on equity volatility. So on net, the owner might also be feeling the pain from the S&P 500’s 6% pullback from all-time highs.

Many of the options purchased are poised to expire next week.

A trader who asked not to be identified has observed sales of August VIX calls at strikes where big buys had been previously made concurrent with the purchase of even further out of the money September VIX calls. Such activity would be consistent with rolling the trade to maintain protection in the event that the tumult in risk assets continues or intensifies, and may not be fully captured by the above table.

There’s also the possibility that these trades are being unwound and monetized in a piecemeal fashion, in contrast to how they were first implemented.

The VIX jumped as much as 5 points on Wednesday, hitting 22.7.

To contact the reporter on this story: Luke Kawa in New York at lkawa@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Rita Nazareth, Dave Liedtka

©2019 Bloomberg L.P.