Mar 25, 2020

50% of small business planning layoffs as confidence hits new low

, BNN Bloomberg

Ontario says 'you won't lose your job if you're sick', but that doesn't pay the bills: Economist

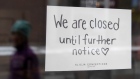

A measure of Canadian small business confidence has cratered to the lowest level on record in the face of the COVID-19 outbreak. The Canadian Federation of Independent Business said Wednesday that its gauge of sentiment is at depths not seen during even past recessions.

In a release, CFIB vice-president anf chief economist Ted Mallett said this spring is shaping up to be an unprecedented time for the domestic economy.

"March 2020 has turned out to be a month like no other in Canada's economic history," Mallett said. "Small business sentiment has never been this low in the Business Barometer's 32-year history, including during the 2008 and 1990 recessions."

The gauge of business sentiment plunged 19 points to 30.8, extending its drop from February’s 60.5, and hit every industry and province.

Hiring intentions among small business owners are equally dire. According to the CFIB, intentions have ground to a halt, with only five per cent of small business owners planning to add staff in the next three months and 50 per cent planning layoffs.

The CFIB is underscoring the need for government support in ensuring small businesses can bring back those workers in short order whenever the economy stabilizes. In an interview Tuesday on BNN Bloomberg, before the latest confidence index was released, Mallett said that was one of two key concerns the organization has been hearing from its members.

“They need an easy way be able to put employees on leave but perhaps be able to top up earnings so that they maintain the ability to bring back skilled workers,” he said. “We’re also noticing issues about rent, including how to deal with our rental bills that may be coming due at the beginning of April. For businesses, that’s a very large expense. Those are the two big issues: workforce and property issues.”

As part of the federal government’s initial $82-billion plan to tackle the virus, employers are being offered a 10 per cent wage subsidy in a bid to encourage businesses to keep employees on the payroll. The subsidy is dwarfed by similar programs in Europe, including Denmark’s offer of 75 per cent subsidies.

Mallett said he believes Canada is being prudent in taking a wait-and-see approach when it comes to the size of that subsidy, and thinks the feds may eventually give it a boost.

“Our hope is we’d be able to replicate [higher subsidies] in Canada if they prove effective [in Europe],” he said.