Jun 24, 2021

A $1.5 Trillion Milestone Beckons for Second-Biggest ETF Market

, Bloomberg News

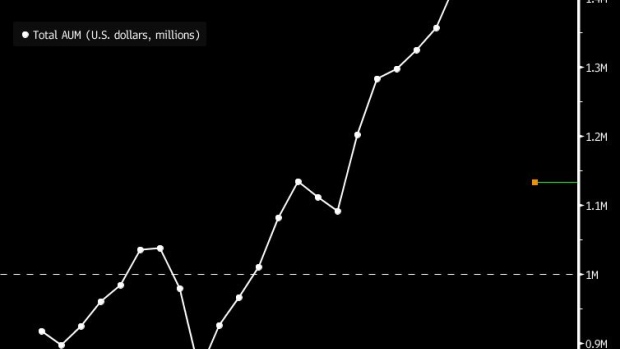

(Bloomberg) -- The first $500 billion in assets took the European ETF market about 16 years to grow. The second $500 billion took more than three years. Eighteen months later, the next milestone is already in sight.

A deluge of inflows has swelled assets in the region’s exchange-traded product industry to $1.475 trillion, according to data compiled by Bloomberg.

If this year’s rate of growth is sustained, the market should top $1.5 trillion in August. Predictions it will pass $2 trillion by 2025 now look “conservative,” according to BlackRock Inc.

“The European market is now growing at a faster rate than that of the U.S.,” said Brett Pybus, head of iShares EMEA investment and product strategy at BlackRock.

Pybus puts it down to the region’s evolving wealth industry, a shift to sustainable investing and the growing adoption of fixed-income ETFs. For a market that’s long played second fiddle to the U.S., those factors are proving “transformational,” he said.

ESG Friendly

Overall flows into European ETPs total $108 billion so far in 2021 -- easily on course to top the record full-year flows of $120 billion notched in 2019.

More than 40% of that new cash in 2021 has gone to products focused on environmental, social and governance standards.

In fact, the product with the most inflows this year is the SPDR Bloomberg SASB US Corporate ESG UCITS ETF (ticker SPPU GR). Having launched in October, the fixed-income fund has attracted $5.6 billion so far in 2021.

“The shift towards sustainability investing is one of the most revolutionary investment developments of our time, and it shows no sign of slowing down,” said Fannie Wurtz, head of ETF, indexing and smart beta at Amundi Asset Management. “We’ve seen demand from investors wishing to reflect their values in their investments, from those who consider ESG a risk management tool and from those who are looking at ESG for performance.”

Europe is a major beneficiary of the ESG boom thanks to a perfect cocktail of regulation -- asset managers are required to disclose that they integrate sustainability into their investment decisions -- and performance. The MSCI Europe ESG Leader Index has beaten the MSCI Europe Index by about 5 percentage points over the past year.

ETPs focused on ESG account for around 10.6% of industry assets in Europe, compared with 1.3% in the U.S., according to Bloomberg Intelligence.

Crypto Crazy

Though still dwarfed by its $6.5 trillion cousin, the European ETF market has managed to gain an edge against the U.S. in other key areas. As well as ESG-focused products, the market for crypto vehicles is flourishing.

While U.S. regulators are dragging their feet on approving a Bitcoin ETF, Europe has more than 30 exchange-traded cryptocurrency offerings. In fact, the best-performing product in 2021 is the $277 million 21Shares Binance BNB ETP (ABNB SW), which was up almost 600% through Tuesday.

For all the fuss surrounding digital currencies, however, equities continue to dominate the landscape.

Assets in stock-focused ETFs alone recently topped $1 trillion. The biggest fund in the region, the iShares Core S&P 500 UCITS ETF (CSPX LN), follows the S&P 500 and has about $46 billion in assets.

Messy Market

Notwithstanding its recent momentum, Europe suffers from structural barriers that make it unlikely to ever close the gap to the U.S. The retail investor base -- a powerful force in America -- is much smaller across the Atlantic. The market is also badly fragmented across countries and trading venues.

“We still have the issue of the fragmentation due to the number of different exchanges,” said Roxane Sanguinetti, head of fixed income and investor relations at market maker GHCO. “There is a genuine need for a consolidated tape. Still, it doesn’t change the fact that ETFs are the financial product of the future.”

While fragmentation is hard to solve, there are at least signs of a pickup in retail investor interest in the region. Pybus says that ETF-based savings products in Germany are booming, with about 2 million plans executed a month. He sees scope for that trend to expand into other countries as savers look to escape negative interest rates.

“Savers are losing money in their saving accounts and these products provide them a way to move out of cash, turning savers into investors. That’s critical,” he said. “We expect it to grow five-fold in the next five years.”

©2021 Bloomberg L.P.