May 29, 2019

A $2.7 Billion Wipeout Ensues When Retailers Lose the Thread

, Bloomberg News

(Bloomberg) -- For apparel retailers, the plot has to unfold just right for investors to buy into the narrative. And by the market’s reaction Wednesday, they clearly didn’t stick to the script.

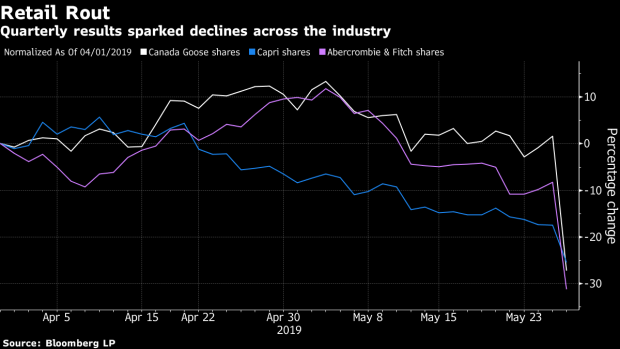

A trio of companies posted historic stock declines Wednesday: Abercrombie & Fitch Co., Canada Goose Holdings Inc. and Michael Kors owner Capri Holdings Ltd., together erasing about $2.7 billion in market capitalization. For Abercrombie, weakening sales cast doubt on the company’s affirmation that it’s in the midst of a sustained rebound. Capri trimmed its sales outlook for the year amid foreign currency weakness and lower revenue from wholesale. At Canada Goose, a slowdown sparked concerns that its era of rapid growth may be coming to an end.

“Any chink in the armor is a devastating story, which is what you’re seeing today,” said Alex Arnold, a managing director of the consumer practice at investment bank Odeon Capital. Investors are sensitive to any signs of trouble with Abercrombie and Capri as both companies adopt new strategies, he said.

Abercrombie shares fell as much as 25%, the most in almost two decades, while Canada Goose plunged 28%, the most since it went public in 2017. Capri declined as much as 12%.

The results further underscore how 2019 is shaping up to be a challenging year for retailers, despite an unemployment rate that’s hovered near record lows and high consumer confidence. A number of pitfalls are emerging, from U.S. tariffs on Chinese imports to unpredictable weather, as well as shoppers’ ongoing migration online.

Asia Key

Abercrombie’s latest quarter showed same-store sales growth slowed for its teen-focused Hollister unit, while the company continues to close flagship locations. That outweighed a better-than-expected performance at its namesake brand. While Abercrombie still projects the key measure of comparable sales to rise in the low-single digits this year, the stock performance clearly shows investors’ skepticism.

Chief Executive Officer Fran Horowitz said Asia is key to regaining the company’s momentum, saying that signs to an improving overseas business will start emerging again at the end of the year.

“We need to get a little closer to the Asian customer and understand that consumer behavior better than we do today,” Horowitz said in an interview.

Capri, meanwhile, is struggling to revitalize its biggest brand, Michael Kors, particularly its U.S. operations after years of heavy discounting took a toll on the business. Executives have worked to clear inventory and restore the brand’s luster, but comparable sales slid 1% in the quarter on a constant-currency basis, a bigger drop than analysts predicted. On Wednesday, the company cited issues including not having enough of its Signature collection of bags on hand during the quarter.

The company is banking on its newest luxury divisions -- Versace and Jimmy Choo -- to underpin growth in coming years. It acquired Versace for $2.2 billion and Jimmy Choo for $1.2 billion, both in the past two years. But those prospects failed to sway investors Wednesday.

Canada Goose may have been the biggest shock. The luxury parka maker has conditioned Wall Street to expect meteoric growth, so when it posted revenue that missed analyst expectations for the first time ever, the reaction was sharp. Its full-year sales forecast also fell short of estimates -- a sign the rapid growth of the past may be waning.

Weather Hit

Bloomberg Intelligence analyst Poonam Goyal said cold spring weather contributed to retailers’ struggles in the first quarter.

“Essentially stores were selling clearance winter clothing and not full-price spring wear,” Goyal said. And while many retailers said there was a pickup in April because Easter was later this year, “trends tell us that the first half of May was weaker.”

Canada Goose Chief Executive Officer Dani Reiss said on a conference call that spring weather is more unpredictable than ever and the window for the selling season is shorter and more variable than fall-winter.

Dick’s Sporting Goods Inc. started out as a bright spot in early trading, but better-than-expected sales, earnings and margins beats were overshadowed by two red flags: Inventory jumped 16%, an indication that discounting may come later in the year. They company’s rosier outlook also was a result of share buybacks, Oppenheimer analysts noted. Excluding the benefits of stock repurchases, they said, earning guidance for the year was actually lower than previously given.

Tariff Pain

With the U.S. poised to level a new round of tariffs on goods from China -- including apparel and footwear -- many retailers are looking to shift some of their supply chain out of the country. Abercrombie’s Horowitz said the company has been moving production to Cambodia and Vietnam. It plans to get less than 20% of its merchandise this year from China, down from 25% in the previous fiscal year.

Neil Saunders, an analyst at GlobalData Retail, said investors reaction to Abercrombie’s report may be too harsh. He cited growth amid “a moderation in overall consumer demand for clothing.”

“That A&F has remained firmly on track, is largely a sign that the underlying strategy is sound,” he said in a research note.

The market will get more opportunities to look at apparel retailers in coming days, with Gap Inc. reporting results on May 30 and American Eagle Outfitters Inc. slated for June 5.

--With assistance from Eben Novy-Williams, Kim Bhasin, David Scanlan and Sandrine Rastello.

To contact the reporters on this story: Jonathan Roeder in Chicago at jroeder@bloomberg.net;Jordyn Holman in New York at jholman19@bloomberg.net

To contact the editors responsible for this story: Anne Riley Moffat at ariley17@bloomberg.net, Lisa Wolfson, Nick Turner

©2019 Bloomberg L.P.