(Bloomberg Opinion) -- The French supermarket chain that owns Paris’s ubiquitous Monoprix stores is selling more of its assets to pay down its debt. Let’s hope all of the disposals make sense for the company, rather than just being a way to restart dividend payments to its struggling parent Rallye SA, the investment vehicle of Jean-Charles Naouri.

The grocery company, Casino Guichard-Perrachon SA (where Naouri is also chairman and chief executive), on Tuesday said it had identified another 2 billion euros ($2.2 billion) of assets to be offloaded over the next 18 months. This would be on top of an initial 2.5 billion euro disposal program due to be completed by early next year.

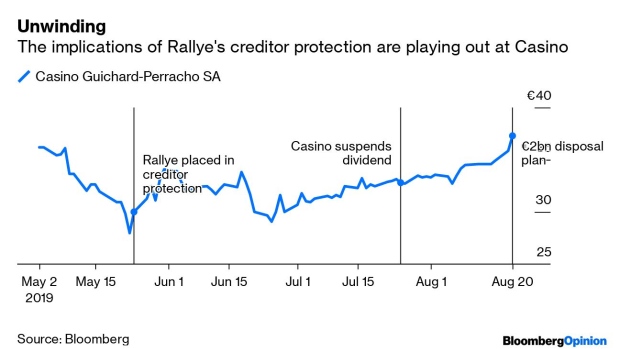

At first glance this looks like good news, with Casino’s shares rising 4%. But it’s interesting that Rallye’s rose by 14%. Casino’s net debt within its French retail business stood at 2.9 billion euros at the end of June, down from 4 billion euros at the same time last year. Selling another chunky tranche of assets would help bring that down significantly.

Unfortunately Casino hasn’t said yet what will be included in the new sale, beyond that the assets will be in France.

The company says it wants to focus on e-commerce, as well as premium and convenience retailing. That would appear to privilege its Cdiscount, Monoprix and Franprix formats, and implies disposals elsewhere such as in hypermarkets, supermarkets and its Leader Price discount division. It’s hard to see that generating 2 billion euros, though.

The worry is that the plan involves selling off more of the company’s real estate and renting it back, particularly sites used by Monoprix and Franprix stores around Paris. That approach was a feature of the first tranche of disposals.

Casino plays down the risks of this strategy. For example, when it sells property it usually signs nine-year rental deals on the sites after which it has the right to renew the terms. Still, there’s a danger that the retailer ends up with a store estate that’s substantially leased, reducing its financial flexibility and exposing it to future rent increases.

The French company has suspended its dividend, a wise move as it restructures the business. But Rallye, which owns 52% of the group, will no doubt be eager to see a quick resumption as it tries to cut its own 2.9 billion euros of net debt. The parent group is in a creditor protection program at present.

Charles Allen, an analyst at Bloomberg Intelligence, says Casino may want to be debt free before reinstating the shareholder payout, indicating that payments will resume when that happens. This would explain why Rallye’s shares and bonds moved higher on Tuesday morning.

Casino is also working toward putting its Latin American assets into a single entity, in which it will hold a 41.4% stake. That could pave the way to a partial disposal and a special dividend, which would send more cash in Rallye’s direction.

The grocer did a good job of exerting its independence from its parent by shelving the dividend. Mortgaging its future to help pay Rallye’s debts would be a step in the wrong direction.

To contact the author of this story: Andrea Felsted at afelsted@bloomberg.net

To contact the editor responsible for this story: James Boxell at jboxell@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

©2019 Bloomberg L.P.