Mar 16, 2023

A Net $3 Billion Was Redeemed From Crypto’s USDC Stablecoin This Week

, Bloomberg News

(Bloomberg) -- A net $3 billion was redeemed from USD Coin, crypto’s second-largest stablecoin, from Monday morning through Wednesday in the aftermath of US banking turmoil that buffeted issuer Circle Internet Financial Ltd.

Circle in a blog post said it had redeemed $3.8 billion of USDC tokens over the period and minted $800 million, adding that a backlog of such requests has been all but cleared.

Stablecoins like USDC are supposed to hold a constant value, often underpinned by collateral like cash and bonds. But USDC slumped from its intended $1 peg over the weekend after it emerged that $3.3 billion of the reserves used to back the token were at the collapsed Silicon Valley Bank.

Regulators later said depositors will get their money back, part of an effort to shore up confidence the US financial system. Circle also pledged to cover any reserves shortfall. Those efforts helped USDC recover its $1 dollar peg.

US banks Silvergate Capital Corp., Silicon Valley Bank and Signature Bank all toppled this month. Silvergate and Signature offered real-time, round-the-clock payments networks for crypto firms. The loss of these facilities has forced digital-asset companies to find alternative banking partners.

Circle said it “went live” with a new transaction banking partner for domestic US and international wires over Tuesday and Wednesday and expects to bring more banking capabilities back “on line” on Thursday.

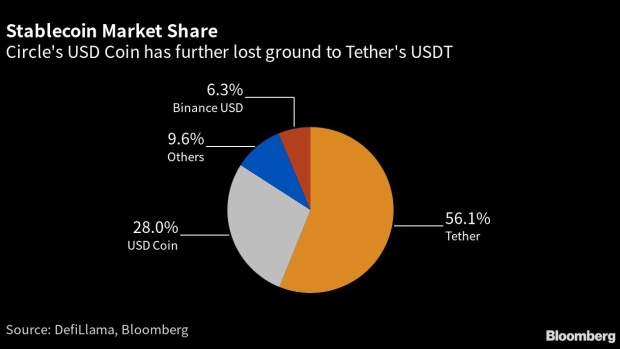

USDC’s circulating supply has dropped by roughly 5.9 billion tokens since March 10, data from DefiLlama shows. In the same period the supply of rival Tether’s USDT has jumped by about 2.5 billion tokens, cementing its status as the largest stablecoin.

©2023 Bloomberg L.P.