Jul 20, 2019

A New Leader Won't Save Most-Hated Market From Brexit's Grip

, Bloomberg News

(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

Whoever wins the U.K.’s leadership race, investors reckon its markets will lose.

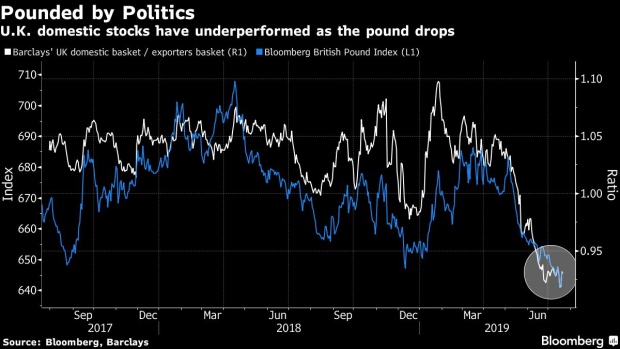

That’s because for years only one thing has mattered to money managers focused on Great Britain -- the risk of a messy divorce from the European Union pummeling the nation’s assets and darkening its economic prospects. It’s a scenario neither frontrunner Boris Johnson nor his adversary Jeremy Hunt may be able to avert.

“Markets will remain fixated on the Brexit process above all else,” said Edward Park, deputy CIO at Brooks Macdonald Asset Management. “U.K. corporate earnings, economic fundamentals and business sentiment all play second fiddle.”

Park is holding below-benchmark positions in equities and the pound, and he’s not alone.

A net 23% of global investors are underweight the U.K., giving it the dubious distinction of most-disliked region for 41 consecutive months, according to the latest Bank of America Corp. fund survey. The pound is the second most-undervalued among the Group-of-10 basket of exchange rates after the euro, based on the OECD’s measure of purchasing-power parity.

Even U.K. corporate bonds have lagged the rally sweeping credit in the U.S. and the eurozone because of political risk.

Former Mayor of London Johnson is seen as more likely to try to push through the option of leaving the EU with no deal, despite the pre-emptive steps taken by Parliament in recent days to neutralize him.

A victory by Johnson could send the pound as low as $1.18, according to strategists. Sterling has lost 3.5% since April, the steepest fall against the dollar among G10 currencies. It traded at around $1.25 on Friday.

Read more: Boris Johnson Faces a Fight for Survival Before He’s Even Won

If Hunt wins, there would likely be a brief pound rally as he is seen as more likely to avoid a no-deal Brexit. Still, he would face all the same problems as May in getting the Brexit deal through Parliament.

The currency could go as high as $1.27 on a surprise Hunt victory, according to Societe Generale SA strategist Kenneth Broux, before giving back those gains when Parliament returns in September.

“Trying to get something through that suits a disparate number of parties and groups in Parliament -- that seems to still be an unachievable task hence why I think sterling has been weakening,” said Leigh Himsworth, a stock fund manager at Fidelity International.

Alexis Charveriat, who manages Financiere de la Cite’s Brexit stock fund from Paris, is hedging pound exposure by choosing internationally-focused companies that get their revenue from outside the U.K. He said he expects “big liquid export names in the pharmaceutical and non cyclical sectors” to outperform.

The new leader will have just three months to try and secure a Brexit deal from Brussels and get it through Parliament. And investors will get little information to trade on as parliament goes into recess until September days after the results of the leadership race are announced.

“As we get closer to the deadline, pressure on U.K. assets could increase where sterling could continue to underperform and gilts rally if we get no clarity,” said Mohammed Kazmi, a portfolio manager at Union Bancaire Privee SA. “These trends could continue in the near term whether it’s Boris Johnson or Jeremy Hunt. There is room for uncertainty to grow.”

--With assistance from Ksenia Galouchko, Laura Curtis, Alice Gledhill and Tasos Vossos.

To contact the reporters on this story: Justina Lee in London at jlee1489@bloomberg.net;Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Samuel Potter at spotter33@bloomberg.net, Cecile Gutscher, Yakob Peterseil

©2019 Bloomberg L.P.